China’s largest tech companies Alibaba Group Holding Ltd. and Tencent Holdings Ltd. have gained $66 billion in market value since May’s end, propelled by expectations of a gradual return to pre-crackdown growth and a litany of official promises to unshackle the private sector. Yet some investors warn the celebration may be premature.

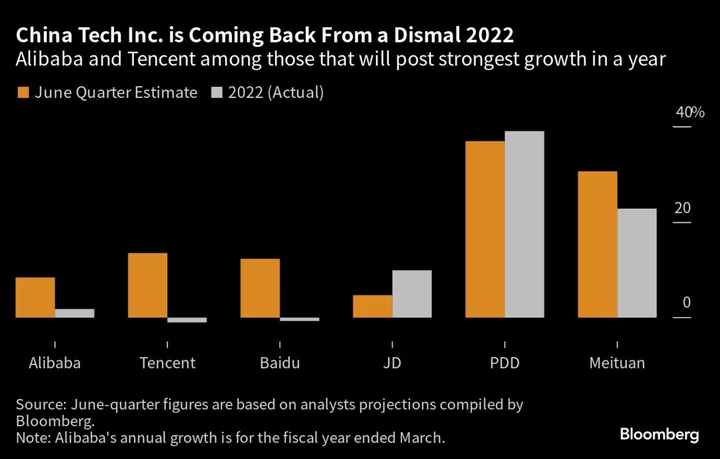

For the first time since 2021, China’s technology leaders head into an earnings season with what appears to be the wind at their backs. They’re set to report their strongest growth rates in over a year.

Driven by a need to rejuvenate the word’s No. 2 economy, Xi Jinping has in recent months led Party cadres and state media in proclaiming Beijing’s support for a trillion-dollar sector wracked by two years of unpredictable diktats. And in July, Beijing signaled it’s ready to unfetter the sector when it wrapped up a probe into Jack Ma-backed Ant Group Co.

Still, investors betting on an inflection point risk getting ahead of themselves.

Chinese policymakers have stopped short of providing direct, major fiscal or policy support for businesses, and consumer spending remains muted thanks to a subdued outlook for wages and record-high youth unemployment. Profit margins remain thin amid rising competition from upstarts that mostly escaped the brunt of the crackdown such as ByteDance Ltd. and PDD Holdings Inc.

While a gauge of Chinese tech stocks has gained 20% since the end of May, it’s down nearly 4% this month as nervous investors take some money off the table ahead of Alibaba’s Aug. 10 report.

“The bottom line is if China’s economy is weak, it will be harder for these Internet companies to outgrow the economy now than before. And of course with all the new regulations and restrictions on these businesses, they are no longer free to seek growth,” said Vey-Sern Ling, a managing director at Union Bancaire Privee.

“The kind of growth that we saw in the past for China is unlikely to return,” he adds.

The quarterly prints will offer the first clue on whether the much-anticipated tech revival has truly begun. Yet even if Beijing hews to its promises, it’s going to be a long slog to even approach the pre-2021 years of deal-making, experimentation and free-form expansion.

Alibaba and Tencent, after shedding more than $350 billion of value since 2020, cut more than 20,000 jobs between them last year to survive regulatory and economic turmoil. They face a two-pronged assault: rivals like Baidu and Meituan are vying for dominance of the Internet thanks to the emergence of generative AI. Baidu has so far stolen much of their limelight in the post-ChatGPT race, debuting Ernie in March before launching into several iterations.

Abroad, ByteDance and PDD’s Temu continue to make strides, building on expansions that began when Alibaba and Tencent were forced to show restraint. During the crackdown, companies including ByteDance’s TikTok, miHoYo, and Temu revved up overseas forays for growth. Despite rising geopolitical tensions, this generation of upstarts offer a template for older peers seeking to regain pre-crackdown heights.

“At this very moment, the priority and the focus is on economic growth,” Weijian Shan, executive chairman and co-founder of Hong Kong-based asset manager PAG, told Bloomberg Television last week. “The sentiment is rather weak and the confidence remains rather subdued. It takes couple years of policy stability for full confidence to return.”

Alibaba and Tencent are also grappling with lingering uncertainty. Last week, investors got a brief reminder of the crackdown years when regulators — with little warning — published a set of rules limiting the amount of time minors can spend on their smartphones.

In March, Alibaba announced a breakup into six mostly independent pieces, a historic split regarded as allowing its individual businesses to pursue new initiatives, while fulfilling Beijing’s goal of cutting its most powerful private enterprises down to size.

With the split, the e-commerce leader is intent on creating a family of leaders in businesses from cloud computing and logistics to international commerce that couls seek funding and listing separately, appeasing shareholders hungry for value. Overseeing the momentous transition are two of Jack Ma’s Alibaba co-founders, Eddie Wu and Joseph Tsai, who will replace eight-year veteran Daniel Zhang at the helm in September. It’s unclear if either will helm the usual post-earnings briefing on Thursday.

“Alibaba’s business is highly leveraged to the economy because it’s consumption based,” Ling said. “In the past, Alibaba was able to outgrow the economy because e-commerce penetration was still low. Looking ahead, it may be harder to do so given high penetration of e-commerce, as well as competition from other platforms.”

Read more: Alibaba Turns to Little-Known Coder to Continue Jack Ma’s Legacy

For Tencent, regulators appear tolerant of a resumption in video gaming, after years of warnings about addiction. But that in turn empowered rivals big and small.

The world’s largest games publisher has struggled to find its next big hit after mobile mainstays Honor of Kings and PUBG Mobile. Executives have declared Valorant its most important game of the year and set aside more than $100 million to spend on its content over the next three years.

But it needs to fight off a slew of big summer releases in China’s $40 billion games arena, which contracted for the first time last year. These include games developed by closest rival NetEase Inc., anime specialist miHoYo and even ByteDance.

On Monday, Goldman Sachs trimmed its estimates on Tencent’s revenue by 0.5% to 0.8%, reflecting sliding ad sales. The broker also cut its target price for the stock by 3.3%.

“Investors will eventually react to underlying earnings growth,” said Jian Shi Cortesi, a fund manager at Gam Investment Management. “But I don’t know when it will happen.”

Top Tech Stories

- Amazon.com Inc. is in talks to join other tech companies as an anchor investor in Arm Ltd.’s initial public offering, according to a person familiar with the situation, part of preparations for a deal that could raise as much as $10 billion.

- Coupang Inc., the online retailer popular in South Korea for dawn and one-day delivery, posted its fourth straight quarterly profit after investments in logistics and membership programs helped shore up margins.

- A US plan to restrict investment in China is likely to apply only to Chinese companies that get at least half of their revenue from cutting-edge sectors such as quantum computing and artificial intelligence, people familiar with the matter said.

- Lyft Inc. shares fell after the company reported its slowest revenue growth in two years, overshadowing a better-than-expected outlook for earnings, as the company struggles to get its ridership back on track.

- Alphabet Inc.’s Google may face a trial in a class action brought by consumers who claim its Chrome web browser continued to collect their data even while navigating online in private “Incognito” mode.

Earnings Due Wednesday

- Premarket

- Diebold

- Postmarket

- Disney

- Infinera

- Viasat

- Trade Desk

- Lions Gate

- Groupon