Asian regulators have stolen a march on the US by clarifying crypto rules, exemplified by Hong Kong’s first licenses for trading platforms under the city’s new digital-asset framework.

Hong Kong opened up to mass-market trading following confirmation Thursday that HashKey Exchange and OSL had won permits that legalize the retail trading of tokens, part of the city’s push to become a global hub for virtual assets.

Hong Kong implemented its mandatory crypto framework in June, the same month that Japan’s stablecoin law became operative and South Korea approved its first standalone digital-asset bill. Indonesia is starting up a government-backed crypto exchange to underpin the sector there.

The region’s officials are seeking to learn the lessons of last year’s $1.5 trillion digital-asset rout and a spate of global bankruptcies, like the wipeout of the FTX exchange, to create frameworks that protect investors while remaining attractive to firms — a challenging balancing act.

“There may be short-term pain as the industry grapples with this leveling up,” said Angela Ang, senior policy adviser at blockchain intelligence firm TRM Labs and a former regulator at the Monetary Authority of Singapore. “But we could see long-term gains in the form of a well-governed, productive crypto ecosystem in Asia, if the industry invests in risk management and works with regulators to define fit-for-purpose crypto rules.”

The US, meanwhile, is mired in a crypto fog amid dueling court judgments, a turf war between regulatory agencies and disputes about proposed laws. Other jurisdictions, like the European Union and Dubai, have also detailed crypto rulebooks. The elephant in the room is China, which has banned crypto but where there are mounting signs of citizens flouting the prohibition.

Here’s a look at digital-asset rules in key Asian jurisdictions:

Hong Kong

Licensed crypto exchanges in Hong Kong can offer trading to individuals and institutions but retail investors are restricted to larger coins like Bitcoin and Ether. The framework stresses the need for adequate risk assessment, insurance cover and asset custody. Virtual-asset companies have given the rulebook a guarded welcome but have yet to commit major investment.

The government has allowed exchange-traded funds investing in CME Group Bitcoin and Ether futures, and sold its inaugural digital green bonds, which use digital ledgers to make the settlement and coupon payment process faster. A mandatory licensing regime for stablecoins — a type of crypto token that’s meant to hold a constant value — is due by 2023-2024.

Read more: Hong Kong Opens to Retail Crypto Trading With New Licenses

Japan

Japan expanded its digital-asset rulebook when its stablecoin law — one of the first among major economies — went into effect mid-year. Soon after, Mitsubishi UFJ Financial Group Inc. said it’s in discussions with multiple parties about using its blockchain platform, Progmat, to issue stablecoins tied to foreign currencies — including the US dollar — for use globally.

Prime Minister Fumio Kishida’s economic agenda includes support for the growth of so-called web3 firms. The term “web3” refers to a vision of a decentralized internet built around blockchains, crypto’s underlying technology. Japan has moved toward easing some crypto rules, such as on token listing and taxation, but overall is viewed as having strict regulations.

Read more: Japan’s Biggest Bank MUFG in Talks to Issue Global Stablecoins

South Korea

South Korea approved its first standalone digital-asset bill just over a year after the implosion of tokens created by countryman Do Kwon exacerbated a crypto-market rout. The code defines virtual assets and imposes penalties for transgressions such as the use of nonpublic information, market manipulation and unfair trading practices.

The legislation gives the Financial Services Commission the power to oversee crypto operators as well as asset custodians. The Bank of Korea would also be able to probe such platforms. The act requires insurance coverage, reserve funds and necessary record keeping. The rules cover assets such as Bitcoin, while existing capital-markets law applies to tokens deemed securities.

Read more: South Korea Passes Inaugural Crypto Bill After Spate of Scandals

Singapore

The city-state’s goal is to develop a hub for productive uses of blockchain, such as tokenizing real-world assets that are currently hard to trade. At the same time, officials are curbing retail-investor participation in crypto-related trading and investments given the history of high volatility in digital assets.

In July, Singapore said it will require crypto exchanges to keep customer assets in a trust before the end of the year. The nation will also push ahead with a proposal to ban lending and staking for retail investors. Staking is the process of pledging coins to help operate a blockchain in return for rewards.

Read more: Singapore Tells Crypto Platforms to Keep Client Money in a Trust

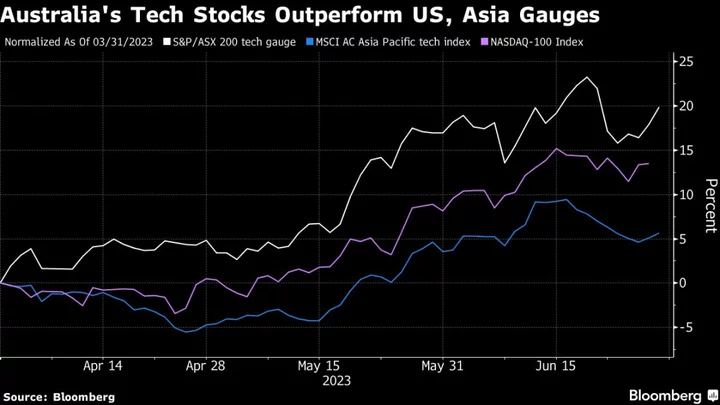

Australia

Australia has indicated it plans a consultation on licensing and custody requirements for cryptoasset service providers that will begin in coming weeks. That development came after an opposition lawmaker introduced a private bill to regulate the digital-asset industry. Meanwhile, the nation’s big banks have curbed access to crypto platforms due to risks from scams.

Read more: Australia’s NAB Blocks Some Payments to Riskier Crypto Exchanges

Indonesia

Indonesia is drawing on the structure of the stock market to revamp crypto trading and mitigate the risks exposed by the collapse of FTX. A key plank of the plan, a state-backed crypto bourse where private-sector platforms will execute trades, is due to become operational in August. The blueprint resembles the way stock markets work by separating trading, clearing and custody under official oversight.

Read more: FTX Mess Spurs Indonesia to Revamp Crypto With National Exchange