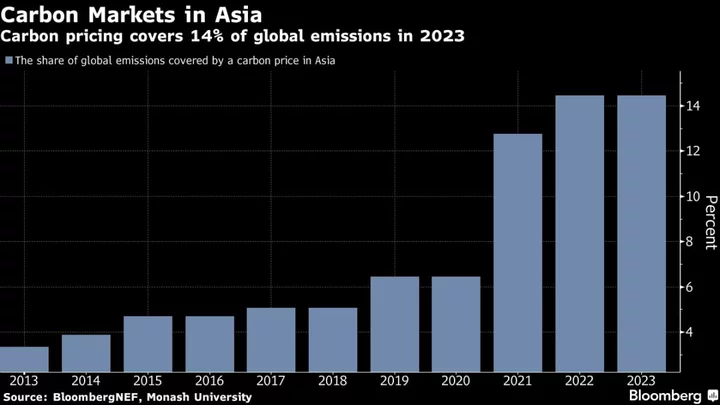

Asia is emerging as the key catalyst for growth in carbon trading, though the region’s markets currently cover only a fraction of emissions that account for half the world’s total.

Indonesia and Japan have launched carbon trading exchanges in the past two months, China — the world’s top polluter — is looking to expand its existing scheme from as early as next year, and India is advancing its own preparations.

“Asia is the fastest moving region in the world in terms of launching, planning and developing new systems,” said Stefano De Clara, head of secretariat at International Carbon Action Partnership. “I wouldn’t be surprised if I saw even more systems coming online over the next few years or so.”

Despite doubling their size since 2020, Asian carbon markets currently cover only 14% of the world’s emissions, while the region produces nearly half of the total. Low carbon prices failed to provide robust incentives for companies to decarbonize, ultimately falling short of delivering the intended climate benefits.

Most governments have been reluctant to push through with a full-scale mechanism over fears of slowing growth, preferring to target specific sectors first.

“We can expect prices to increase as systems mature in the coming years,” De Clara said. “It’s often a deliberate choice for emission trading systems to start with a relatively low price to make sure that participants understand how the system works.”

Australia

The federal government revised the Safeguard Mechanism to put Australia’s biggest industrial polluters on a pathway to net zero by mid-century. The updated scheme commenced in July, encompassing more than 200 facilities responsible for almost a third of the country’s emissions.

China

The Ministry of Ecology and Environment is set to expand its carbon market beyond power generation to other polluting sectors as early as next year. The national emissions trading scheme targets 2,200 power producers emitting 4.5 billion tons a year of CO2 equivalent. By the end of the decade, Beijing plans to expand trading to cover 70% of its total emissions.

India

The Indian government proposed a phased introduction involving two mechanisms: a compliance market that sets a cap-and-trade system for carbon intensive sectors, and a voluntary market still in the design phase.

The compliance market should be launched within the next two years, and cover 15% of India’s emissions by 2030, targeting steel, aluminum and cement among other sectors, according to Abhay Bakre, director general with the government’s Bureau of Energy Efficiency.

Indonesia

The Indonesia Carbon Exchange kicked off in September to facilitate trading of both voluntary offsets and compliance allowances. Currently, only the voluntary platform is active. The country is expected to roll out a compliance market in three phases by the end of the decade.

The government is also drafting three pieces of legislation that will serve as the foundation for the country’s long delayed carbon tax.

Japan

Japan’s first voluntary carbon trading scheme, operated by the Tokyo Stock Exchange Inc., started in October. Participants can trade so-called J-Credits, issued by the government for verified emissions reduction plans. The launch followed the release of a 10-year carbon pricing plan, which sets out to develop the existing Green Transformation League, a public-private forum, into a national compliance system.

Malaysia

The Ministry of Finance teamed up with the World Bank to study the feasibility of a carbon pricing instrument, and is expected to share its results in 2025. In December 2022, Bursa Malaysia Bhd. set up Malaysia’s first voluntary carbon market.

New Zealand

The country launched its emission trading system in 2008, now being strengthened with a reduction of carbon units auctioned and a higher price floor. The review is aimed at accelerating emissions reductions.

New Zealand will become the first country to tax agricultural emissions from 2025, which would extend carbon pricing beyond traditionally covered sectors. Typically, carbon taxes and emissions trading systems have focused on hard-to-abate sectors like energy and steel.

Singapore

Singapore introduced a carbon tax in 2019 at S$5 ($3.65) per ton of CO2-equivalent. It will raise the levy to S$25 in 2024, and then lift it gradually to S$50 to S$80 by the end of the decade. The government will release details of its international carbon credits framework in the second half of this year. The country’s central bank has recently proposed a carbon credit model targeting the retirement of coal-fired power plants across Asia.

Singapore currently doesn’t operate a compliance carbon market.

South Korea

South Korea set out to improve its nationwide emission trading system after the prices of allowances plunged to a record low this year. The government announced plans in September to extend participation in the scheme, and to launch futures products to boost liquidity in the struggling market.

--With assistance from Stephen Stapczynski.