Analysts don’t quite know what to make of Coinbase Global Inc.’s valuation.

The stock has jumped almost 80% since mid-June, buoyed by BlackRock Inc.’s application to launch a Bitcoin exchange-traded fund and Ripple Labs Inc.’s partial court win against the Securities and Exchange Commission a month later. That’s left some analysts ratcheting up price targets for the crypto exchange, while others say the stock has decoupled from reality. There’s a 75% gap between the highest and lowest price targets issued since the Ripple ruling.

Amid the divergence, much rides on Chief Executive Officer Brian Armstrong’s ability to reassure investors about Coinbase’s growth prospects when it reports second-quarter earnings on Thursday after the market close.

Stock bears like Berenberg’s Mark Palmer say the stream of good news that lifted Coinbase doesn’t have any bearing on its growth outlook, which has been hurt by the SEC’s clampdown on the company and the wider sector. In response to the bleak US environment, Armstrong is embarking on an overseas expansion.

“We are surprised that the market was as exuberant as it was, simply because the company continues to face very significant risks on the regulatory front,” said Palmer, a senior research analyst at Berenberg. He rates the stock a “hold” and calls it “uninvestable in the near term.” His price target is $39, compared with Wednesday’s close of $90.43.

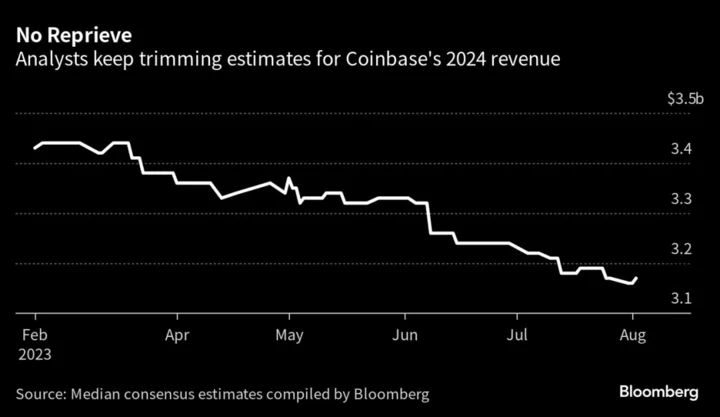

Analysts don’t expect Armstrong’s overseas push to meaningfully alleviate pressure on revenue at least through next year, estimates compiled by Bloomberg indicate. Since Bloomberg News first reported in March about plans to potentially set up a new crypto-trading platform overseas, consensus estimates for 2024 revenue have kept drifting lower as the SEC sued Coinbase.

Coinbase is expected to report a 23% drop in second-quarter sales from a year earlier, estimates compiled by Bloomberg show. Quarterly transaction revenue was the lowest since the company went public in 2021, analysts predict.

The July 13 ruling by a US federal judge that Ripple’s XRP token is a security when sold to institutional investors but not the general public triggered a 24% rally in Coinbase stock, the biggest one-day gain since April 2021. Investors, at least initially, saw the decision as a big win for crypto platforms like Coinbase, which was sued in June by the SEC for allegedly running an illegal exchange, broker and clearing agency.

Since then, analysts including Citigroup Peter Christiansen have sharply raised their price targets for Coinbase, while others like Palmer and Benjamin Budish of Barclays kept theirs unchanged. Estimates for what Coinbase shares are worth range from $36 to $145 since July 13, Bloomberg-compiled data show. The stock was little changed in early trading in New York on Thursday.

The inherent riskiness of relying on court decisions for assessing crypto’s outlook became apparent on July 31, when another federal judge issued a diverging ruling in a separate case. Coinbase fell 4.5% the next day.

Taken as a whole, the view on Coinbase stock is unusually bearish by Wall Street sell-side standards: It gets a consensus rating of 3.03 out of 5, lower than all but 37 stocks on the S&P 500 Index. Only one company on the benchmark has a lower projected return potential, based on the difference between the average target price and the current value, than Coinbase.

To defend a valuation that’s tripled this year based on the price-to-sales metric, Armstrong needs to find new growth avenues.

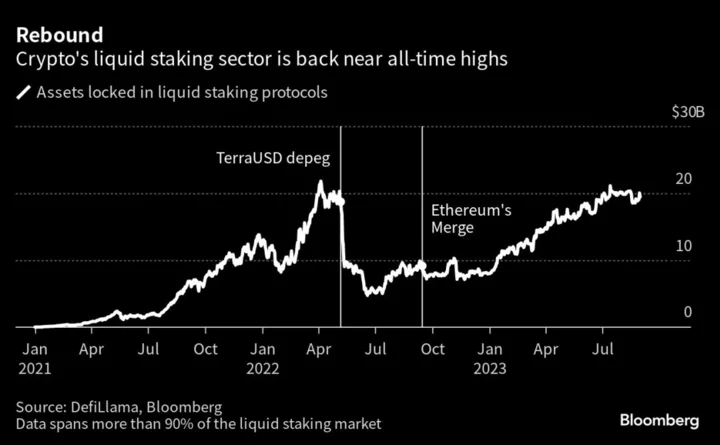

Interest income, a key sales driver, is expected to have dropped almost 20% from the prior quarter after circulation of the USDC stablecoin declined. Meanwhile, revenue from staking is under pressure after Coinbase was ordered to stop staking additional assets in four US states.

Regulatory pressure on crypto companies in the US has reached such intensity that Armstrong in April said he won’t rule out moving the San Fransisco-based company abroad. After being sued by the SEC, Coinbase has said it’s willing to take its legal fight with the regulator to the Supreme Court if needed.

Crackdown on Binance

The company in May launched the Coinbase International Exchange, on which some investors based outside the US can trade crypto derivatives. The venue saw $2.1 billion of trading volume in the past 30 days. Global trading in Bitcoin futures alone totaled $550 billion last month, data compiled by the Block show.

One force working in Armstrong’s favor as he eyes overseas markets is the regulatory crackdown on Binance in markets from Belgium to Australia. Binance, Coinbase’s biggest competitor, has ceded market share in past months as it came under increased scrutiny.

In Europe, the biggest winner from Binance’s woes has been Kraken, which boosted its share of trading in euro-denominated crypto pairs to 43% in July from 36% in January, according to CCData. Coinbase increased its share slightly.

Underscoring the task facing Armstrong, even analysts that are bullish on the stock don’t expect Coinbase’s international platform to generate meaningful revenues at least through next year.

“Coinbase has a history of putting out products like NFT [marketplace] that didn’t materially generate things for bottom line or top line,” said John Todaro, an analyst at Needham & Co. with a “buy” rating and a price target of $120 for Coinbase. “We do think it’s an opportunity, but it’s very early.”

--With assistance from Sidhartha Shukla.

(Updates with Thursday’s stock move in 10th paragraph.)