For years, cryptocurrency startups have tried to replicate parts of the US stock market on the blockchain for use by digital-asset investors around the world, often without worrying too much about getting approval from regulators first.

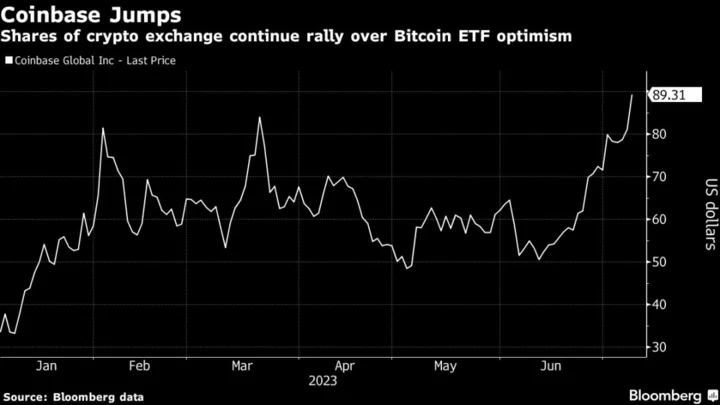

The latest project, however, is an attempt to turn equities into crypto tokens in a way that won’t run afoul of securities laws, and it has scored the backing of one of Wall Street’s most well-known trading firms. Susquehanna International Group joined former Coinbase Global inc. executive Balaji Srinivasan and other investors in funding the company called Dinari, based in Los Altos, California.

The co-founders of Dinari have acquired a broker-dealer in the US, subject to final approval by the Financial Industry Regulatory Authority. They’ve also registered with the Securities and Exchange Commission as a transfer agent, allowing the company to perform tasks such as distributing dividends and maintaining records of securities ownership.

“Oftentimes people, especially in the crypto space, are just afraid of regulation. And the thing is, in a lot of ways, they shouldn’t be,” Gabriel Otte, co-founder and chief executive officer of Dinari, said in an interview. “Look at the US stock exchanges. We are probably one of the highest-regulated ecosystems in the world. But it’s allowed us to flourish and grow since the 1920s into what really has become the most-robust market for securities in the world.”

The project is part of a growing list of efforts to turn real-world assets into digital tokens that trade on blockchains. Decentralized finance, the corner of the crypto world that proponents hope to make a more transparent and decentralized version of Wall Street, once offered triple-digit returns during an era of ultra-low interest rates. But the tables have turned following last year’s collapse of several lending projects and an environment of more-favorable returns in the relative safety of traditional assets.

Founded in 2021, Dinari’s flagship product, Dinari Securities Backed Tokens, or dShares, allows investors outside the US a way to use cryptocurrencies to buy shares of some of the largest US companies and exchange-traded funds, including Tesla Inc., Walt Disney Co. and Nvidia Corp. The platform, which went live earlier this month, is offered under Regulation S, a set of rules that allows for SEC-compliant sales of securities to overseas investors.

Unlike some previous projects, these tokenized stocks are backed one-to-one by real-world shares purchased by Dinari. The company uses Alpaca Securities LLC and Interactive Brokers Group Inc. for custody of the actual equities.

The most well-known previous efforts to tokenize US stocks included the Mirror Protocol built on the Terra blockchain. Those unregistered tokens drew SEC scrutiny even before the collapse of Terra’s stablecoin caused some $40 billion in losses and triggered a global manhunt for the project’s co-founder, Do Kwon. Kwon is currently serving a four-month sentence in Montenegro for traveling on a fake passport, and both the US and South Korea are seeking his extradition to face charges for his alleged role in the stablecoin’s failure to maintain its intended $1 value.

Read: SEC Seeks to Question Do Kwon’s Terra Co-Founder in South Korea

Dinari has raised $7.5 million in seed investment from investors including SPEILLLP, which is a Susquehanna International Group company, venture-capital firm 500 Global, former Coinbase chief technology officer Srinivasan and VC investor Sancus Ventures.

Once a user is verified by Dinari according to “know your client” rules, the investor can purchase tokenized shares by paying with stablecoins such as USDC. Token holders earn dividends, but cannot vote directly as shareholders. The platform collects a fee from every purchase.

Every trade on Dinari can be monitored by anyone, thanks to the underlying blockchain technology. Otte said they are looking for a third-party auditor.

Dinari has its work cut out for it when it comes to creating anything that remotely resembles the functionalities of the world’s largest stock market.

Holders of the stock tokens initially can only sell them back to Dinari. The platform’s goal is that the tokens will be widely used in the crypto market — either as collateral for borrowing or by swapping them for other security tokens. Purchases of the tokens are not available outside of US trading time. And according to Jake Timothy, co-founder and chief technology officer, Dinari is non-custodial, meaning that users need to hold the tokens in their own digital wallets.

Navigating securities laws around the world will also be a challenge. Dinari faces “complex regulatory landscapes across jurisdictions,” said Lake Dai, founder and managing partner at Sancus Ventures, one of the project’s investors.

“The end game of Dinari is to use our broker-dealer licenses to be able to have an operating exchange where these securities can be traded,” Chas Rampenthal, co-founder and chief legal officer of Dinari, said in an interview. “In order to run, you have to walk, and in order to walk, you have to crawl,” he said. “This is kind of our way of getting started.”