The European Central Bank wants finance executives to know they’ll be held to account for the industry’s continued failure to adequately manage climate and environmental risks.

According to Frank Elderson, executive board member of the ECB, the ESG risk building in some bank books “increasingly calls into question the fitness and propriety” of the executives in charge.

Banks are taking too long to treat climate and environmental risks as a material threat that can impact their finances, according to the ECB. Elderson’s speech, given five years after the European Union started rolling out its sustainable finance agenda, represents one of the ECB’s sternest warnings yet on the subject.

Banks that don’t meet the ECB’s risk management requirements for climate and the environment “will have to pay a penalty for every day the shortcoming remains unresolved,” Elderson said on Tuesday.

The comments add to a drumbeat of warnings from EU officials intent on getting the bloc’s finance industry to step up its ESG risk management. Last month, the European Banking Authority said it was revising the framework that sets capital requirements so that lenders reflect environmental and social risks in so-called Pillar 1 buffers.

The new rules are needed because environmental, social and governance factors are “changing the risk profile for the banking sector,” the EBA said on Oct. 12.

Elderson said the ECB expects banks to treat climate and environmental risk as they would “any other material risk.”

- To register for a Bloomberg Intelligence webinar about key things to watch in the run-up to COP28, click here.

The requirement, which is laid out in Europe’s Capital Requirements Directive, gives banks in the EU until the end of next year to comply, though the ECB has set a number of interim deadlines.

In the course of its supervision of the banking sector’s exposure to climate and environmental risk, the ECB has “seen a number of good practices,” Elderson said. However, “at present, none of the banks under our supervision fully meet all our expectations,” he said.

(For more on ESG news, click on TOP ESG.)

NEWS ROUNDUP

Raw Materials | The EU reached a deal on measures to become more self-sufficient in the key raw materials it needs to help power the clean energy transition.

Misogyny | The head of the Federal Deposit Insurance Corp. told lawmakers that his agency had launched an investigation into reports of misogynistic culture among bank examiners that prompted women to quit the agency.

Spanish Reprieve | Banks, asset managers and other financial firms have won a reprieve from Europe’s most consequential ESG regulation to date, as a wave of intense industry lobbying pays off.

ECB Weighs In | The finance industry should be included in Europe’s plan to hold companies accountable for environmental and human rights violations in their value chains, the ECB’s Elderson also said.

CSRD Fallout | Companies based outside Europe are reviewing securities they’ve listed in the bloc, as the implications of an overlooked clause in new ESG reporting rules sink in.

French Restrictions | France will only let funds use the national ESG label if they blacklist fossil-fuel companies that are expanding production.

Methane | The EU aims to slash methane emissions by clinching a deal that may have global ramifications if major energy importers are targeted over leaks of one of the most potent greenhouse gases.

Crypto | A top financial regulator is crafting a plan to ensure that more derivatives exchanges keep client funds separate from their corporate cash, the latest response by US policymakers to the havoc wrought by fallen crypto giant FTX.

Investor Pressure | Danish pension funds are calling for all financial institutions to be included within the scope of an EU proposal that would hold companies liable for environmental and social damage stemming from their value chains.

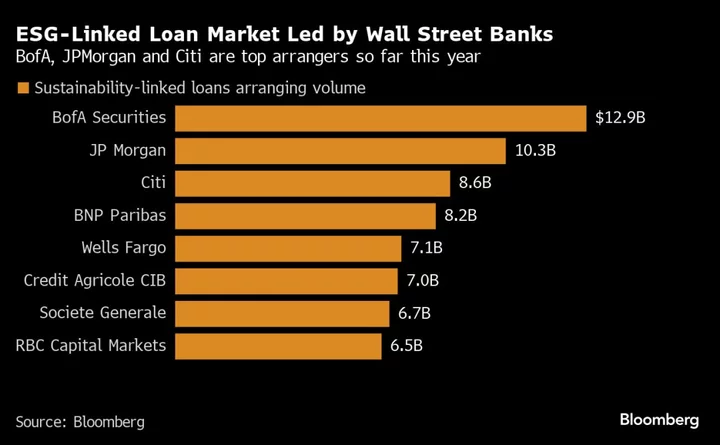

SLL Clauses | Bankers servicing one of the world’s biggest ESG debt markets are now actively seeking legal protections to guard against the potential greenwashing allegations that may be ahead.

Fitch Warning | Much of the fossil fuel industry may be facing an era of credit downgrades if producers prove too slow to adapt to a low-carbon future, according to Fitch Ratings.

Redlining | Top US banking regulators have updated decades-old rules that are meant to tackle redlining and boost lending to lower-income areas.

Nature Deal | The EU clinched a deal to advance one of the most controversial aspects of its green agenda: How to restore nature that has disappeared due to human activity.

BLOOMBERG RESEARCH

Green Hydrogen | The US Department of Energy has opened funding negotiations with seven hydrogen hubs to give the country’s green H2 – hydrogen produced with renewable energy – a $7 billion boost. Yet blue H2, which is produced with fossil fuels and carbon capture, is likely to be the real winner. (BloombergNEF)

ESG Appetite | ESG has moved into the C-suite as a backbone of financial markets and corporate strategy, driven by global regulation and competitive ambitions. (Bloomberg Intelligence)

A Global Panel: C-Suite and Senior Investors

US Election | The 2024 US election may be a catalyst for industrial and consumer regulation, potentially impacting electric vehicle makers like Ford, Tesla and General Motors and those that supply EV infrastructure like Eaton and General Electric. (Bloomberg Intelligence)

OFF THE SHELF

Corrections | For years, financial professionals made exaggerated ESG claims that fed a market boom with little in the way of oversight. That era of exuberance around environmental, social and governance investing is now coming to an end with increasingly consequential waves of regulations. In the US, where ESG has also become embroiled in partisan politics, the fallout is evident in the shrinking pool of assets carrying an ESG label: down by more than half over the past two years. In Europe, new regulations led the world’s biggest asset managers to strip coveted ESG tags from about $190 billion in aggregate client funds in the latter part of 2022. And there’s more to come.

Central Banks | Some of the world’s largest central banks are joining the fight against climate change. Though melting glaciers may be a huge leap from monetary policy, policymakers say they must respond to threats that have the potential to disrupt the global economy. Some critics say climate policy is better left to politicians, particularly in countries where central banks are hemmed in by explicit government mandates.

Taxonomies | Floods, droughts and food shortages are just some of the effects of climate change, as exploitation and corruption drive social injustice around the world. Governments tackling these issues are realizing that to solve them, they need to first define and measure them. Some are turning to so-called taxonomies that establish which economic practices and products are harmful to the planet and which aren’t. The idea is the price of goods and services must reflect the human and environmental cost of both production and disposal, which in turn would spur much-needed change. But designing a code is fiendishly difficult.

Double Materiality | Should a business or an investment fund care only about making money, or should it also worry about the environment, social justice and good governance? Can the two goals overlap? Do they already? These questions get to the heart of something called “double materiality.” While the concept has been built into new European regulations, it has yet to make significant inroads in the US — even as Wall Street behemoths like JPMorgan Chase & Co. embrace the idea. At issue is what information should be mandatory to report, and who decides?

Circular Economy | Take, make, use, dispose. For decades, this has been the standard approach to production and consumption. Companies take raw materials and transform them into products, which are purchased by consumers, who ultimately toss them out, creating waste that ends up in landfills and oceans. Worried about climate change and environmental degradation, people are challenging the sustainability of this linear model and urging a so-called circular economy of take, make, use, reuse and reuse again and again.

ABC | You’ve probably heard of ESG, and may know it as a form of investing and finance that involves considering material financial risks from environmental factors, social issues and questions of corporate governance. If you’re like most people, you’re probably not clear on the difference between ESG and socially responsible investing, impact investing and similar, sometimes overlapping approaches — in part because ESG has come to mean different things to different people. That vagueness has helped fuel rapid growth in recent years. But accompanying those gains has been increased scrutiny from regulators cracking down on banks and investment firms making exaggerated claims.

OTHER ESG-FOCUSED FIXTURES

Run NSUB ESG to subscribe to the ESG newsletters listed below:

- For the ESG Daily newsletter, click here

- For the daily “Green Insight” newsletter, click here

- For the weekly wrap of ESG bond sales, click here

- For the weekly ESG Investing digest, click here

- For the weekly wrap of Equality news, click here