Will Butler-Adams doesn’t have much patience for cars, or public transport for that matter. Especially on a warm day. “What on earth are you doing?” he says. “Scuttling under the ground, getting shoved into a metal tube, being belched on. Get on a bike and whiz across town and discover your city.”

Unsurprisingly, the Brompton Bicycle Ltd. boss wants urban workers to jump on one of his bikes. The fold-up models are popular with commuters who can carry them on to public transport, and also have an army of international devotees.

But Butler-Adams doesn’t want to stop there. His solution to London’s crusade against polluted air, which saw the extension last week of Mayor Sadiq Khan’s ultra low-emission zone (Ulez), is to kick the cars out altogether. He envisions a future where travelers will drive to the edge of a city in an electric Tesla, park, and hop on a bike to continue their journey.

“Driving around in a 2.5 ton metal box to do two miles is not going to solve our climate crisis,” says Butler-Adams during an interview at Brompton’s factory in the western suburb of Greenford, part of the expanded Ulez zone. The most efficient mode of transport invented is the bicycle, he says. After that, people should “use your legs.”

Ulez

Butler-Adams is particularly exercised over the political wrangling about Ulez, in which Labour leader Keir Starmer said his party must be doing something “very wrong” over the traffic control policy following its loss in the Uxbridge and South Ruislip by-election earlier this summer. Some in the opposition party think Khan, the Labour mayor, has pushed green policies like Ulez too hard.

“Politics has become so short-term,” says Butler-Adams, over a cup of tea in his cluttered office. “As soon as the slightest little upset comes, they won’t do anything. So they stagnate, and sit there and fester.”

We’ve just finished a short bike ride around the industrial estate where Brompton has its factory and head office. Butler-Adams, 49, has led the company since 2008 when its founder, Andrew Ritchie, stepped back. Butler-Adams describes Ritchie as “extraordinarily eccentric and a megalomaniac” — traits he sees as a positive. “He wouldn’t have the bike if it wasn’t for those two things because he spent 13 years designing the bike.”

Today, Brompton employs 820 people and built its one millionth bike last year. But when he started, it had about 40 employees and was making 6,000 bikes a year.

At a starting price of £950 ($1,204), Brompton bikes are not cheap. For a super lightweight, titanium version, prices can reach more than £4,415. To spread the cost — and to allow customers to try out a Brompton — the company has introduced a subscription, where cyclists can pay monthly to rent a bike.

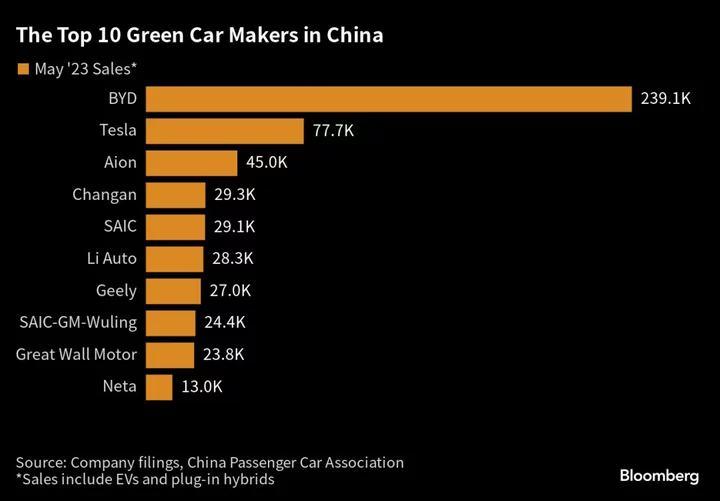

Today, China is Brompton’s fastest-growing market, where the bike is seen as a premium product. Between 20% and 22% of sales are now in China, up from 4% five years ago. “We’re in shopping malls next to Stella McCartney,” he says.

‘Total Carnage’

Covid was a mixed blessing for bicycle companies. On the one hand, the pandemic led to bottlenecks in global supply chains; on the other, demand soared as people sought an alternative to public transport. Manufacturers and retailers duly increased orders — but now, the cost-of-living crisis has dented demand for high-ticket, discretionary items, leaving the industry reeling.

Bike manufacturers have gone bust and Halfords Group Plc, the UK’s largest retailer of bicycles and accessories, said in January that the cycling market was down 20% year on year.

“There is total carnage in our industry at the moment,” says Butler-Adams. He says some manufacturers forced shops to take the stock, flooding the market with bikes. For Brompton, it means customers may be tempted to buy a competitor’s bike at a discount.

“We haven’t seen the end of it,” he says. “It’s bad out there. And not just suppliers, shops will go bust, manufacturers who supply them will go bust.”

At Brompton, Butler-Adams was forced to commit to material orders 12-18 months in advance while demand was high, but as sales fell, he was left with £15 million worth of parts. Brompton took some debt to cover the cash trapped in stock, which it paid back by the end of last year. In May, Brompton raised £19 million from backers including the Business Growth Fund Ltd., selling a minority stake. The company is majority-owned by Butler-Adams, Ritchie and their friends and family.

The squeeze on margin was shown in Brompton’s numbers. While sales rose 40% to £106.9 million in the year to March 2022, pretax profits fell from £9.7 million a year earlier to £7.3 million. Nonetheless, it is still planning a £100 million new factory in Kent, southeast of London.

Brexit

Brompton’s margins have been squeezed by rising costs of logistics, wages, raw materials — as well as the impact of Brexit. Butler-Adams says another price rise will soon be necessary.

On a tour of Brompton’s vast assembly line, Butler-Adams pauses in front of a stack of boxes, each containing a bike. Labels show addresses for Austria, Romania, Finland and France. Until Brexit, these bikes would have flowed out of Brompton’s factory directly to bike shops across the continent. In a post-Brexit world they are first shipped to a distribution center in Amsterdam — allowing a single piece of paperwork to export bikes into the EU.

“It’s bonkers,” Butler-Adams says, of the additional red tape. “It takes longer, it costs more.” It also makes customer returns more difficult. “The idea of trying to bring anything through that border is a total nightmare,” he says.

Despite the added logistics, Butler-Adams has reason to be hopeful about Britain’s chances. “It frustrates me that people say we can’t make stock, we’re not a maker, we’re a service economy,” he says. “Well hold on. Where are we? In London — making bikes selling all over the world.”

Today, Brompton is regularly invited to talk to big companies such as Deloitte, HSBC and Prudential about how to get more people cycling. Employers have clocked that encouraging people to cycle leads to less absenteeism. It marks a change from the early days, when he was a “complete fruitcake” for suggesting that workers should cycle to the office. “I was the real weirdo riding a bike, and no one listened to me.”