(Bloomberg Markets) -- Singapore is a small country that lives at the sharp end of several big global stories: US-China tensions, climate change, the explosion of financial wealth and the rise of technology. We asked experts and political leaders how the city-state will adapt to an uncertain future. Their responses have been edited for clarity and length.

How will Singapore change over the next 10 years?

Lawrence Wong Deputy prime minister and finance minister of Singapore; designated successor to Prime Minister Lee Hsien Loong

Great power rivalry is back. Extreme competition between America and China will shape the future of the global order. The major countries want to build up their defense industrial bases and strengthen their manufacturing capabilities for key technologies. This means businesses will be organized not just by economic logic, but also by geopolitical orientation and national security concerns. A significant rewiring of global supply chains is underway. Singapore will adapt, focusing on sectors where we have competitive strengths—for example, in specific segments of advanced manufacturing, transportation and logistics, and financial services. We are embracing digital technologies and investing heavily in human capital. In this volatile external environment, there will be more churn in our economy and more stresses on our society. That’s why the government intends to do more to provide assurance and support for our citizens through the stages of life—be it to access quality education, purchase affordable homes, secure good and well-paying jobs or to retire with peace of mind. Our society, too, will continue to evolve. We expect a greater diversity of views and preferences, and more civic participation.

Pritam Singh Leader of the opposition in Singapore’s Parliament

I have previously spoken in Parliament about the perception of “two Singapores,” where the bounty of social and economic success is enjoyed only by a few, and not distributed fairly. Such perceptions, if left unchecked, will inevitably lead to feelings of resentment, cynicism and despair—creating class-based friction and other fissures in our society. Whether “two Singapores” will manifest itself into reality a decade from now depends not just on the government of the day, but also on individual Singaporeans. They must be courageous in employing their voices politically to support those that may be less fortunate among us and ensure that the rising tide of economic growth lifts all ships, and not just the superyachts.

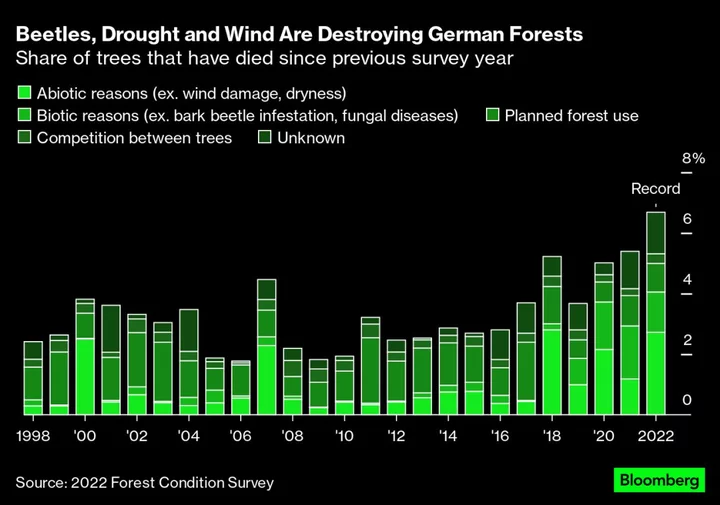

Rachel EngManaging director of law firm Eng & Co., a member of the PwC network

Like many other countries, Singapore has to manage the “energy trilemma,” balancing environmental sustainability, reliability and affordability. But for a small city-state, these challenges are more acute. It has no rivers to generate hydropower, nor idle land to place wind turbines for wind energy. And while it has an abundance of sunshine all year round, there’s limited space for storage of the solar energy generated. I expect Singapore to invest more in the coming years in the research and development of renewable energy and, in its usual fashion, to use rules and regulations or pricing incentives to guide the behavior of the market toward renewables.

Omar Slim Co-head of Asia ex-Japan fixed income at PineBridge Investments

In the next 10 years, I believe Singapore’s role as an economic safe haven will solidify, positioning the country as a preeminent wealth and innovation center. This view is supported by Singapore’s legal robustness, stability and relative openness. These have, to some degree, become challenged in parts of the world. The reality is that the world needs economic safe havens.

Rob Subbaraman Head of global markets research at Nomura Holdings Inc.

There’s a growing trend toward a US-aligned bloc and a China-aligned bloc, and where will Singapore fit in? Singapore has tended to have a hedging policy over the past 10 years. I think that’s going to become more challenging, and Singapore may have to pick a side.

Related to that is a trend that we’re already starting to see: this great reallocation of foreign direct investment and production out of China. Southeast Asia and India are very well positioned to become new production bases and factories to the world, and that could be hugely beneficial to Singapore as the financial hub.

Tamara Henderson Southeast Asia economist at Bloomberg Economics

I think the biggest change will be in the ranking of key trading partners. I expect China’s importance to decline and Southeast Asia’s to rise. Two big changes may net out: The working-age population will be shrinking at a faster pace, but the capital stock—productive assets such as plants and equipment—is likely to be growing at a faster pace because of the government’s infrastructure push. The combination should keep growth potential relatively stable.

Lily Kong President of Singapore Management UniversityWith greater exposure to global trends and diverse perspectives, the electorate is increasingly vigilant and discerning. Their expectations will continue to raise the stakes for political leaders and political parties. They will place greater emphasis on the importance of ethical conduct and transparency as non-negotiable elements of good governance. There will also be more concerted demands for inclusivity in policy formulation, to acknowledge the diverse needs and aspirations of different segments of society.

Tariq Ahmad Asia-Pacific co-head of Franklin Templeton

We see continued digitalization of the financial-services industry as an unstoppable trend and the biggest change for Singapore over the next decade. As a result of years of government-led programs, Singapore has emerged as a leading fintech hub globally.

Zulkifli Baharudin Executive chairman at Indo-Trans Logistics Corp. and Singapore’s nonresident ambassador to Kazakhstan and Uzbekistan

A new generation of leaders will have to craft a political ideology and bring on board a population who have no memories of the hard years. Domestic politics is becoming more contested. Some of the lessons left behind by the founding fathers are still relevant, but a political, economic and social transformation is much needed to deal with new realities. Income inequality, if not managed, will extract a heavy toll on a fragile multi-ethnic society. But there is hope as shown in the recent presidential elections where a hugely popular figure [ Tharman Shanmugaratnam] was able to gel and unify the people with overwhelming support.

Kishore MahbubaniFounding dean of the Lee Kuan Yew School of Public Policy, National University of Singapore

The 21st century will be the Asian century. Each century searches for a natural capital. In the 19th century, the European century, London was the natural capital. In the 20th century, the American century, New York was the natural capital. The natural capital for the Asian century is Singapore. Why Singapore? Asia is a rich, multicivilizational continent. Only one city in Asia comfortably accommodates several Asian civilizational streams, including the Chinese, Indian and Islamic streams. These are carefully blended with the modern Western stream. As power shifts to Asia, and as people look for a one-stop place to understand the great Asian renaissance, there’s only one global city that can provide this.

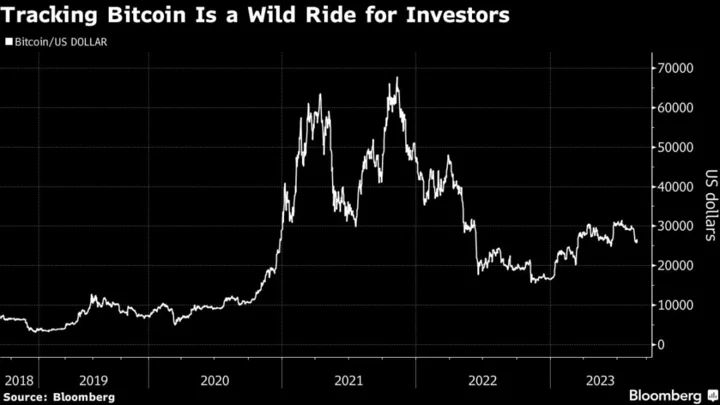

Angela Ang Senior policy adviser at TRM Labs, a blockchain analytics company

We have a well-educated local workforce that’s been put through a rigorous education system. But it’s no longer just about the ability to ace exams and amass knowledge—artificial intelligence can do that. It’s also about making sense of the world in a way that machines can’t. Singapore increasingly gets this. We’re celebrating different paths in life, different definitions of success. We’re accepting that failure is not fatal but could be a steppingstone to success. As a result, we’ve seen more Singaporean businesses emerge, thrive and expand well beyond our shores. Some have even achieved unicorn status.

Taimur Baig Managing director and chief economist at DBS Bank Group Research

Singapore has three structural challenges: aging, climate change and inequality. Over the next decade, I’d pick inequality as the biggest one. Singapore’s growth model has been anchored around low taxation, and a modest public expenditure base that makes provisions for housing, education and health care, along with a world-class transportation infrastructure, but without an expansive safety net. In recent years, between the pandemic and the war in Ukraine, domestic and external shocks have pushed up inflation and cost of living to uncomfortable levels. A more fair and just society is an officially stated goal, but efforts to narrow the wage gap, improve retirement savings and train working adults to keep up with disruptive tech waves are costly. A more progressive income tax structure and additional wealth tax are obvious solutions, but they come with trade-offs with respect to Singapore’s standing as a low-tax jurisdiction. —With Suvashree Ghosh, Philip Heijmans, Bei Hu, Netty Ismail, Malcolm Scott and Andrea Tan