A plan to reboot a new version of defunct crypto exchange FTX Group may emerge as soon as next year, potentially injecting a jolt of activity back into a market that’s been largely subdued since the platform’s collapse.

More than 75 bidders have been contacted by the FTX estate since May to gauge industry interest in backing a relaunch of the exchange, according to a presentation filed in a Delaware court. Several parties have submitted bids that are now undergoing due diligence and information sharing, managers of the estate said, with a deadline for any new bids set for Sept. 24.

FTX was one of the world’s largest digital-asset trading platforms prior to its bankruptcy in November. It was a key part of the crypto empire controlled by its now-jailed chief executive Sam Bankman-Fried, who is set to stand trial on fraud and other charges next month. FTX’s failure, along with sister platforms FTX.US and Alameda Research, triggered an industry-wide fallout that left billions of dollars in assets locked up in customer claims. Bankman-Fried has pleaded not guilty to all the counts against him.

Read more: FTX Seeks to Appoint Novogratz’s Galaxy to Manage Crypto Hoard

The FTX estate’s bidding process is considering varying potential structures for a potential “FTX 2.0”, it said. Any eventual deal could see it negotiate “an acquisition, merger, recapitalization or other transaction to relaunch the FTX.com and/or FTX US exchanges,” according to the filing.

A stalking-horse bid, referring to the baseline offer that any subsequent bidders must improve upon, is to be selected by Oct. 16 with an amended plan filed by year-end. Confirmation of the target plan is expected in the second quarter of 2024, the filing said.

A total of $16 billion in customer claims against FTX and its varying companies were filed as of Aug. 24, with nearly $11 billion in claims scheduled by the estate against the FTX.com and FTX.US exchanges. Meanwhile, the estate has recovered around $7 billion in assets across FTX’s web of accounts and global entities, the filing said, including $3.4 billion denominated in cryptocurrencies.

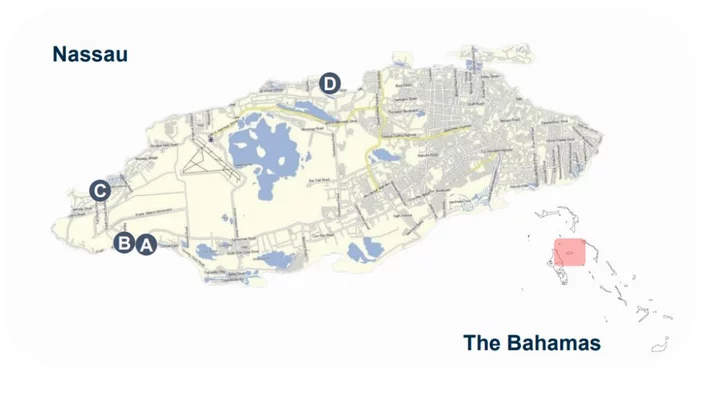

The company’s network of 38 properties spread across the Bahamas, once FTX’s home base, has been assigned a book value of $222 million. The portfolio includes a $151 million compound of condo units and a penthouse inside Albany Marina.

--With assistance from Jeremy Hill and Jonathan Randles.