Orsted Slumps as US Wind Cost Ruling Stokes Writedown Fear

Shares in Orsted A/S fell the most in more than a month after New York regulators ruled against

2023-10-13 17:49

Tesla's deliveries expected to fall on plant shutdowns, soft demand

By Aditya Soni Tesla may miss estimates for third-quarter deliveries due to planned factory shutdowns and soft demand

2023-09-29 18:30

Reddit on New Pricing Plan: Company ‘Needs to Be Fairly Paid’

A number of Reddit forums plan to go dark for two days later this month to protest the

2023-06-06 19:23

Toyota Stops Car Assembly Lines After Server Runs Out of Disk Space

Toyota was forced to stop production at 12 car assembly plants late last month because

2023-09-07 00:46

During Busy Book Launch, Local Author Emma Nadler Pauses to Speak at Daughter’s School, Franklin Center

MINNEAPOLIS--(BUSINESS WIRE)--May 17, 2023--

2023-05-18 06:56

US banks rethink social media as a threat, not a marketing tool

By Nupur Anand NEW YORK Bankers are beefing up risk management, monitoring and emergency procedures around the use

2023-05-18 13:16

China Weighing Ways to Ease Coal Reliance, Canada Minister Says

China’s reliance on coal — and how to reduce it — was a key topic of discussion at

2023-09-02 06:58

The Kindle Paperwhite is on sale for under $90 this Prime Day

TL;DR: The Kindle Paperwhite is on sale for $89.99 this Prime Day. This deal is

2023-07-11 17:55

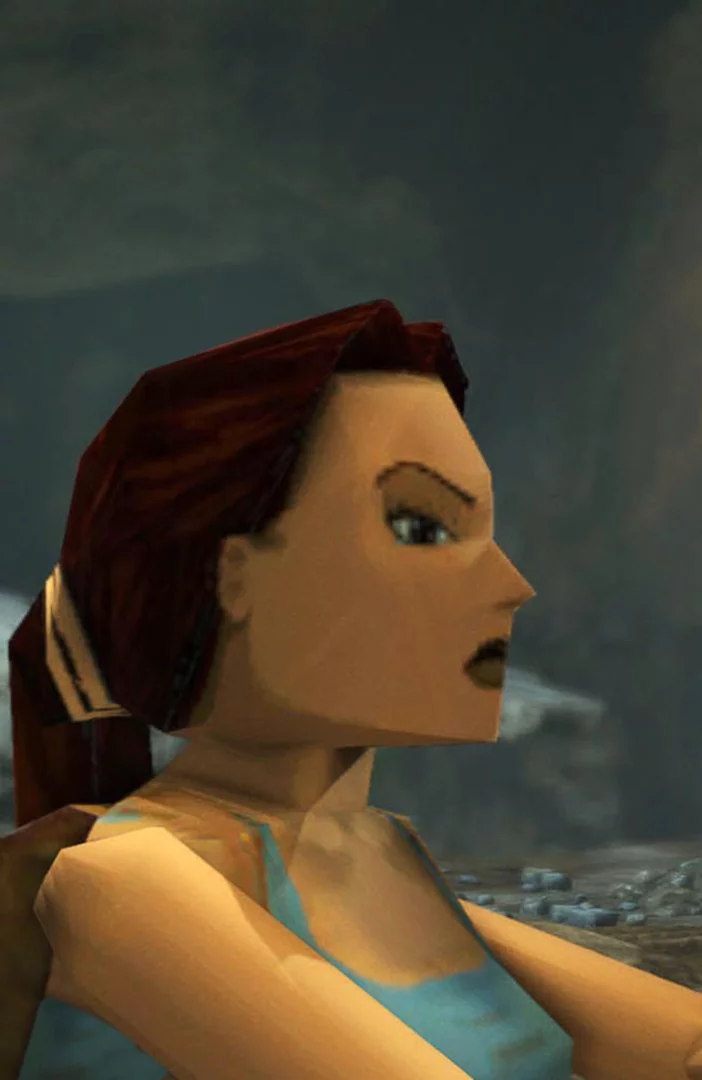

YouTuber gives Tomb Raider 2 a makeover

The classic video game 'Tomb Raider 2' has been given an update by YouTuber Delca.

2023-10-11 00:16

U.S. Air Force Awards Advanced Battle Management System (ABMS) Indefinite-Delivery/Indefinite-Quantity (IDIQ) Contract to ARC, Inc.

WASHINGTON--(BUSINESS WIRE)--Jul 27, 2023--

2023-07-28 06:54

Rhinostics Selected to Exhibit RHINOstic® Automated Swab Platform at Vizient Innovative Technology Exchange

WALTHAM, Mass.--(BUSINESS WIRE)--Aug 10, 2023--

2023-08-10 20:17

Ransomware criminals are dumping kids' private files online after school hacks

Ransomware gangs have been stealing confidential documents from schools and dumping them online

2023-07-05 15:57

You Might Like...

Dell's revenue forecast signals AI boost will take longer to materialize

Corsair K55 RGB Pro Review

Italy plans state-backed fund to promote AI startups

EY Announces Clearfield’s Cheri Beranek as an Entrepreneur Of The Year® 2023 Heartland Award Winner

Kamala Harris called out for awkward description of AI: ‘Kind of a fancy thing’

Greenlight Launches Free, Interactive K-12 Personal Finance Curriculum to Improve Financial Education in Schools Nationwide

Court rejects Elizabeth Holmes' latest effort to stay out of prison while on appeal

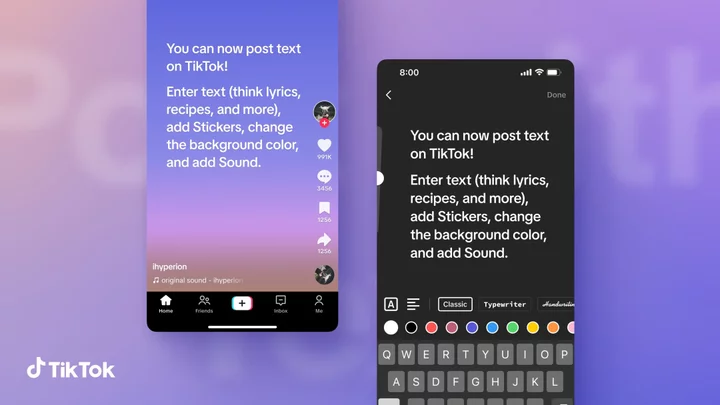

TikTok launches text posts amidst Twitter 'X' rebrand