Trio of Super Mario Advance titles heading to Switch this next week

The three games will be available from May 26.

2023-05-19 20:21

MGM Websites Remain Down After Cyberattack Hits Casinos and Hotels

MGM Resorts International’s websites, including its reservations platform, remained down early Tuesday after a cyberattack that began two

2023-09-12 21:52

Your paycheck could clear faster now that the FedNow instant payment service for banks has launched

The Federal Reserve has launched a new instant payment service that allows banks and credit unions to sign up to send real-time payments so they can offer customers a quicker way to send money between banks

2023-07-20 22:49

Apple unexpectedly supports Right to Repair Act

Apple on Thursday confirmed it is endorsing passage of a California law requiring major gadget makers to enable people to fix their devices without...

2023-08-25 01:55

Netflix, Disney, Amazon to challenge India's tobacco rules for streaming-sources

By Aditya Kalra and Munsif Vengattil NEW DELHI Streaming giants Netflix, Amazon and Disney on Friday privately discussed

2023-06-02 19:48

Get two 3-in-1 Apple device chargers for $35

TL;DR: As of September 4, get this 3-in-1 Apple Watch, AirPods & iPhone Charging Cable

2023-09-04 17:26

10 of the best cryptocurrency courses you can take for free

TL;DR: A wide range of cryptocurrency courses are available for free on Udemy. Learn about

2023-06-08 11:45

Chatbots ‘able to outperform most humans at creative thinking task’

Bots such as ChatGPT may be able to outperform humans at certain creative thinking tasks, scientists believe. Researchers have found that artificial intelligence (AI) chatbots are capable of a skill known as divergent thinking – a spontaneous thought process or method used to generate creative ideas by exploring many possible solutions. When assessed with a type of divergent thinking exercise known as alternate uses tasks, which asks a person to think of as many uses as possible for a simple object, chatbots, on average, performed better than humans. However, the researchers also found that the best human ideas still matched or exceeded those that came from AI. Simone Grassini, associate professor in the department of psychosocial science at the University of Bergen, and Cognitive and Behavioural Neuroscience Lab at the University of Stavanger, in Norway, told the PA news agency: “Indeed, this is a remarkable type of ability that AI chatbots display. “The findings show that AI is better than most humans in creative thinking. The findings show that AI is better than most humans in creative thinking Prof Simone Grassini “But we should also remember that we used the divergent thinking task to measure creative thinking, that is, measuring a particular type of creative thinking and not creativity in general. “Our results show that, at least for now, the best humans still outperform the AI.” For the study, published in the journal Scientific Reports, Prof Grassini and her colleague Mika Koivisto, of the department of psychology at the University of Turku, in Turku, Finland, assigned alternate uses tasks for four objects – a rope, a box, a pencil and a candle – to 256 human volunteers and three AI chatbots – ChatGPT3, ChatGPT4, and Copy.Ai. The responses were rated on semantic distance – looking at how closely related the response was to the object’s original use – and creativity. The team said that on average, chatbot-generated responses scored significantly higher than the human responses for both semantic distance and creativity. The best human response outperformed each chatbot’s best response in seven out of eight scoring categories – however responses from people had a higher proportion of poor-quality ideas, the researchers added. Prof Grassini said: “Playing around with ChatGPT, I noticed that some of the answers given by the chatbot displayed a good level of creativity. “I knew that the chatbot would have performed well, but I think it performed even better than what I expected.” The researchers said that while their work highlights the potential of AI as a tool to enhance creativity, it also underscores the unique and complex nature of human creativity that may be difficult to fully replicate or surpass with AI technology. Prof Grassini said: “It is still to be established whether these capabilities of AI will translate directly on AI systems, replacing human jobs that require creative thinking. “I prefer to think that AI will be helping humans to improve their capacity.” Read More Charity boss speaks out over ‘traumatic’ encounter with royal aide Ukraine war’s heaviest fight rages in east - follow live Information Commissioner urges people to share data to protect at-risk children Long-form video content is here to stay, says YouTube UK boss Robotic dog brought into survey historic Cold War weapons testing facilities

2023-09-14 23:26

Sony Acquires High-End Headphone Maker to Boost PlayStation

Sony Interactive Entertainment is buying audiophile gear maker Audeze LLC in a bid to advance the sound experience

2023-08-25 02:56

Former Fox News host Tucker Carlson will relaunch his show on Twitter

(Reuters) -Former Fox News host Tucker Carlson, who was taken off the air by the network last month, said on

2023-05-10 05:49

Reddit's API protest just made John Oliver a special job offer

Over on Reddit, the protest continues. It's been almost a month now since thousands of

2023-07-11 18:46

Thales and Intel Collaborate to Enhance Trust in Confidential Computing

MEUDON, France--(BUSINESS WIRE)--Sep 20, 2023--

2023-09-21 01:26

You Might Like...

Who are BaboAbe and Natsumi? Ludwig and Pokimane extend support to streamers amid separation

Can Doctors Self-Prescribe Medications?

Cummins, Daimler, PACCAR form joint venture for US battery cell production

The best drones for beginners

Relax Fund Portfolio Manager, AI Isn’t Taking Your Job—Yet

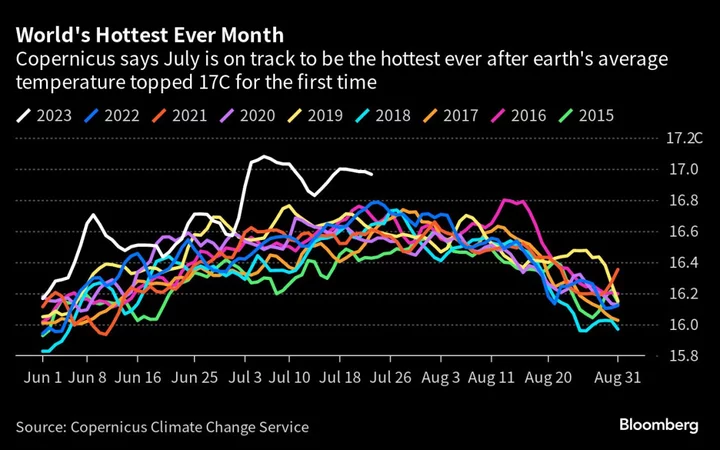

Europe Wildfire Risk Spreads to French Riviera as Heat Retreats

Killer Lakes: Why Limnic Eruptions May Be the World’s Rarest Natural Disasters

Algoma Central Corporation and Furetank Co-Order Two Additional Newbuilds