iOS 17: Apple adds host of new features to iPhone with new software update

Apple has revealed iOS 17, with a host of new features for the iPhone. The new update includes updates to central apps, including Messages, FaceTime and the Phone app. It also adds a new app, in the form of “Journal”, which Apple says will help people practise gratitude. The new update also tweaks other parts of the iPhone experience, including AirDrop. Now users will be able to share more information through it – including contact details – and transfers will happen when users go out of contact. :: Follow The Independent’s live coverage of Apple’s event here

2023-06-06 01:56

U.S. Senate leader schedules classified AI briefings

WASHINGTON Senate Majority Leader Chuck Schumer said on Tuesday he has scheduled three briefings for senators on artificial

2023-06-06 21:24

EY Announces Michael Lombardo of GlideFast Consulting as an Entrepreneur Of The Year® 2023 New England Award Winner

BOSTON--(BUSINESS WIRE)--Jun 12, 2023--

2023-06-13 06:19

Anticipating Orlando Residential Development Buildout, City of Mascotte Officials Visit Leading-Edge Onx Pod Factory

ORLANDO, Fla.--(BUSINESS WIRE)--May 11, 2023--

2023-05-11 21:26

The ChatGPT and Python programming bundle is on sale for 74% off

TL;DR: The 2023 Ultimate AI ChatGPT and Python Programming Bundle is on sale for £32,

2023-09-23 12:56

What happened to Christopher Rooney as TikTok star found after going missing

A TikTok-famous creator Chris Rooney has been found safe after going missing in Fredericksburg Virginia. Concerns grew for Rooney, famously known as the "Yeet Baby" creator, who was last seen on July 25 in his town of 30,000 people. In a since-deleted story on his Instagram account, they said: "He has been found safe. He is safe. Thank you for your prayers." The news of his disappearance soon hit social media, where fans frantically tried to piece together his whereabouts. Before he was found, one creator by the name of @joysparkleshine took to TikTok to explain the situation. She later followed up with an update, informing followers he had been found. The 35-year-old gained viral fame when he started posting on TikTok in January 2020. He is the man behind the "Yeet Baby" account that has since racked up 5.6 million followers. On the account, Rooney frequently posts clips with his niece Marleigh. Rooney is married to his wife, Emily, and the pair share Louie the cat together. Reports have suggested the pair are going through a divorce. Their separation was confirmed in one of his TikToks. Sign up for our free Indy100 weekly newsletter It comes after a Reddit post went viral which saw Rooney respond to a TikTok troll that said: "Alcohol is poison. You lost your beautiful wife because of it so that tells me you need to stop drinking 100 per cent. Have you tried naltrexone? Reddit - Dive into anything from tiktokgossip "If a man said something like this to my face, with such confidence and such inaccuracy… that it’s not even remotely true… Comments like this, they trigger me," he said. "They make me an angry person. So please don’t make me an angry person. Because if I’m around other angry people, you know… we’re going to have to get to fighting because too many stupid comments like this." Officials have not yet disclosed the circumstances behind Rooney's disappearance. Have your say in our news democracy. Click the upvote icon at the top of the page to help raise this article through the indy100 rankings.

2023-08-04 18:19

The best VPNs for crypto trading and Bitcoin payments

Don't worry. We're not going to even attempt to explain the intricacies of the cryptocurrency

2023-07-18 17:52

Pre-Sales of Mojave Flash LiDAR Now Available Through Brevan Electronics

PORTLAND, Ore.--(BUSINESS WIRE)--Sep 12, 2023--

2023-09-12 17:18

EA announces Black Panther single player game from new studio

EA has officially announced its single player 'Black Panther' game.

2023-07-11 19:26

Apple, defying the times, stays quiet on AI

Resisting the hype, Apple defied most predictions this week and made no mention of artificial intelligence when it unveiled its latest slate of new products, including...

2023-06-09 00:21

Zuckerberg Posts First Tweet in 11 Years in Threads Jibe at Musk

Mark Zuckerberg posted his first tweet in more than a decade, a playful jab at Elon Musk on

2023-07-06 10:29

Perseids 2023: Meteor beacon offers unique way to observe spectacular shower over UK

A group of amateur radio enthusiasts have set up a beacon in the UK that allows anyone to observe meteors as they burn through the Earth’s atmosphere. The UK Meteor Beacon project uses radio signals to identify meteorites as they pass through a 400 km-wide section of sky over England and Wales. The data is then displayed on a live online feed, with meteors appearing as blue streaks that emit a ping followed by a trailing pitch. The system captures more than 100 meteors every hour, even during times of relatively low activity. For the upcoming Perseid meteor shower, which peaks on 12 August, the frequency could be in the region of thousands per hour as Earth passes through the tail of the Swift-Tuttle comet. Unlike optical astronomy, the use of radio signals mean that meteors can be observed in nearly any weather conditions at all hours of the day and night. It also means that the system can pick up smaller meteors that may not appear as ‘shooting stars’ to the naked eye. This method of observation could potentially lead to the discovery of new meteor showers, which could then be tracked to uncover previously unknown comets. The radio transmitter is based at the Sherwood Observatory near Mansfield in Nottinghamshire, however receivers can be placed anywhere in the country. “The transmitter is illuminating the sky above Mansfield with radio signals that can be reflected by meteors and their trails,” Brian Coleman, who designed the system’s hardware and has a receiver in his back garden, told The Independent. “Even outside the Perseids and other meteor showers we’re seeing them at a rate of two a minute – and we can observe them day and night no matter what the weather. Only thunderstorms and lightning can interfere with it.” It is the first meteor beacon system run by amateur radio and astronomy volunteers in the UK, and has already received funding from the Radio Society of Great Britain and the British Astronomical Association. It has also gained the attention of academic and citizen scientists keen on studying meteors. Setting up the beacon transmitter is only the first part of the project, with the four-person team now planning to design and deploy echo receivers that can be distributed throughout the country at distances of up to 1,200 km from the Sherwood Observatory. The receivers can be built for as little as £10, according to Mr Coleman, using plastic pipes and other materials found in DIY stores. His hope is that the low cost will encourage schools to set up their own receivers to develop STEM-related projects that will encourage students to explore radio engineering and astronomy. Observations of the meteors from different directions can also be used to calculate the location and trajectory of meteors, with the team currently trying to establish whether it is possible to triangulate the meteors by studying the horizontal lines and blue smudges that appear on the waterfall display. Such measurements are currently possible with military-grade pulse radar systems, but it has never been done before on this scale. If it is possible, then knowing the speed and direction of the meteors will allow them to calculate the landing spot of any meteors that make it through the Earth’s ionosphere without burning up completely. These samples can then be studied to offer a better understanding of the universe. “The ultimate ambition is to have a system like Blitzortung, which uses a network of ground-based detectors to track live lightning strikes around the planet,” Mr Coleman said. “If successful, we could observe meteors entering Earth’s atmosphere in real-time throughout the world – but there’s still a lot of work to do before we achieve that.” Read More Amateur astronomers make ‘major breakthrough’ in saving Earth from asteroids ‘It’s becoming like an airport’: How SpaceX normalised rocket launches Perseid meteor shower offers best chance to see a ‘shooting star’ in 2023 Watch live: Russian cosmonauts step out of ISS to perform spacewalk Earth hit by powerful ‘X-1’ solar flare, after fears of ‘cannibal’ blast

2023-08-10 05:27

You Might Like...

'Reminds me of Mixer': Pokimane opens up about Twitch streamers moving platforms as she returns from hiatus

Airbnb forecasts slower bookings in Q2, shares fall

Crypto Goes Mainstream in Germany: 28% of Gen Z Crypto Users Utilize Digital Currencies for Payments

Appeals Court Refuses to Allow US to Limit Oil Drilling Auction

Heat Builds in Germany This Week as Iberia Finally Gets Cooler

Adin Ross' high school friend Misha apologizes to him for 'publically rejecting' him after he hit on her

Japan aircon king Daikin looks to custom chips for energy savings

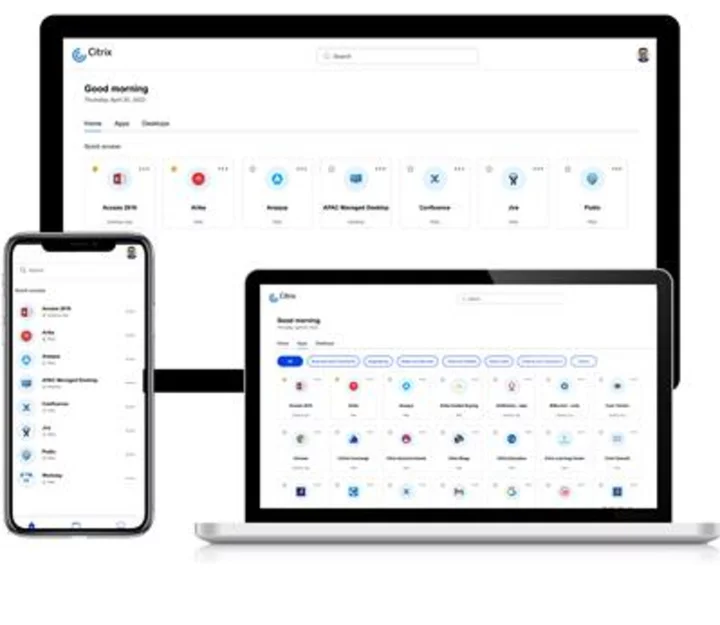

Citrix Expands Cloud and On-Premises Capabilities to Support the Needs of Hybrid Customers