Aquana Announces New Remote Shutoff Valve for Water Utilities

HOUSTON--(BUSINESS WIRE)--Jun 12, 2023--

2023-06-12 21:46

JPMorgan fined $4 million for deleting 47 million emails including some requested in subpoenas

The Securities and Exchange Commission fined JPMorgan Chase $4 million for mistakenly deleting 47 million emails, many of which the regulator was trying to access as part of multiple probes.

2023-06-24 00:47

Prime members: Grab an Amazon Fire TV Stick for just $23

SAVE 43%: The newest Amazon Fire TV Stick is on sale for $22.99 for Amazon

2023-09-21 23:47

iPhone 15 Fever Is Here — So Are Its Cases, Chargers, & Accessories

Were you already planning to line up on launch day for the new iPhone 15? Neither were we. For us, a new iPhone launch means two things: All previous generations go on sale and new accessories that are compatible with most old models are released. While opting to get officially branded ones is always an option, you’ll have better luck with more affordable (while still top-rated) options. For ultra-protective cases and super-powerful chargers, Zagg — the brand best known for its top-notch, cutting-edge tech accessories — is the one to choose when you value quality and aesthetics.

2023-09-21 23:47

Amazon's Echo Show 15 is a smart hub for connected homes

It’s time for me to come clean. While I’m fully on board with smart devices

2023-07-12 23:47

When Can I Pre-Load Final Fantasy 16?

Players can pre-load Final Fantasy 16 on June 19, three days before the game releases.

2023-06-16 06:45

Tristan Tate slams journalist amid alleged COVID vaccine connection to Shane Warne's death, Internet says 'stupid anti-vaxxer'

Tristan Tate has received backing from fans for his comments on Matt Shea, with supporters rallying behind him

2023-06-22 19:54

Washington is determined to govern AI, but how?

By Diane Bartz and Jeffrey Dastin WASHINGTON U.S. lawmakers are grappling with what guardrails to put around burgeoning

2023-05-15 18:16

Reed Messer: Ex-teacher faces multiple rape charges involving student 9 years after leaving school

The sexual relationship that lasted almost two months reportedly began in October 2014

2023-05-11 01:54

Astronomers find unprecedented ‘disc’ around distant planet

Scientists have found the first ever disc structure around a star outside of our own Milky Way. The disc is around a young massive star forming in a stellar nursery called N180. It is within the Larg Magellanic Cloud, a dwarf galaxy that neighbours ours. The disc is 163,000 light years from Earth – meaning that it is not only the first to be detected outside of our galaxy, but also the most distant such disc ever seen. Lead author of the study, Dr Anna McLeod from Centre for Extragalactic Astronomy, Durham University said: “When I first saw evidence for a rotating structure in the ALMA data, I could not believe that we had detected the first extragalactic accretion disc; it was a special moment. “We know discs are vital to forming stars and planets in our galaxy, and here, for the first time, we’re seeing direct evidence for this in another galaxy. “We are in an era of rapid technological advancement when it comes to astronomical facilities. “Being able to study how stars form at such incredible distances and in a different galaxy is very exciting.” The findings are reported in a new article, ‘A likely Keplerian disk feeding an optically revealed massive young star’, published in Nature. Read More Scientists find planets moving around in strange ‘rhythm’ Astronomers discover new six-planet system Scientists have cooked ‘alien haze’ that could help find life

2023-11-30 00:16

Artur Michalczyk, Telecom and CPaaS leader, appointed as Chief Technology Officer at emnify

BERLIN--(BUSINESS WIRE)--Aug 3, 2023--

2023-08-03 16:52

Google is excellently trolling Flat Earthers

Oh Google, you naughty old devil. Someone in Silicone Valley is rolling around in laughter after pulling off this hilarious prank at the expense of the Flat Earth community. Flat Earthers believe that the world is flat, and that any evidence to the contrary is faked. Their belief that the world is flat has been described as the ultimate conspiracy theory, as they also think that several governments and NASA are working together to keep the general public in the dark. Sign up to our free Indy100 weekly newsletter Now, one member of Google's workforce has decided to take matters into their own hands with this subtle but oh-so-effective troll. Log onto Google, and access Google Translate. When you're in there, type in 'I'm a flat-earther' in English, then look at the French translation. If you're not a fluent French speaker, then the translation might need explaining. Try flipping that box around again and see what you get. In other flat earthers news, they announced that they think that Australia - yes, that massive, dusty continent that's given us Kylie Minogue, and has a population of 24 million - doesn't exist. In a now-deleted Facebook post, one of the leaders of the movement Shelley Floryd wrote: Australia does not exist. All things you call 'proof' are actually well-fabricated lies and documents made by the leading governments of the world. Your Australian friends? They're all actors and computer-generated personas, part of the plot to trick the world. If you think you've ever been to Australia, you're terribly wrong. The pilots are all in on this and have in all actuality only flown you to islands close nearby - or in some cases, parts of South America, where they have cleared space and hired actors to act our as real Australians. As if that wasn't enough, they also said that they think that gravity doesn't exist and that the only real force is electromagnetism. Right... Now we see why Google set up the troll. Have your say in our news democracy. Click the upvote icon at the top of the page to help raise this article through the indy100 rankings.

2023-07-13 19:50

You Might Like...

Kimberly Palmer: How to stay safe from financial scams

Apple iPhone 15 vs. Google Pixel 7: Android and iOS Do Battle

GM will adopt Tesla's North American charging standard

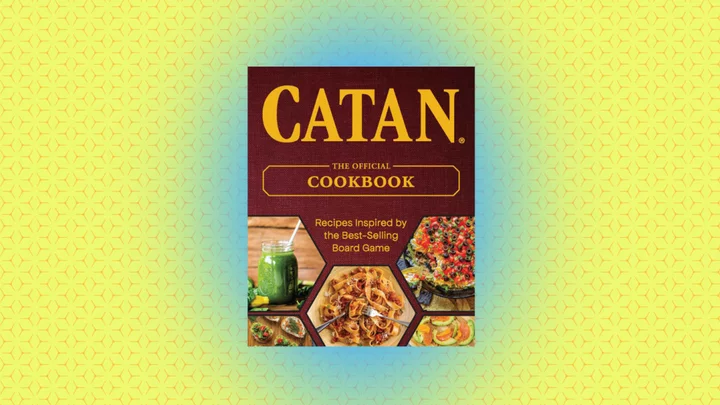

Make Family Game Night Even Better With This New Cookbook Inspired by ‘The Settlers of Catan’

UK Prepares to Scrap EU Pollution Rules to Boost Housebuilding

Indiana Brothers Receive Esports Scholarships From Manchester University

Fieldpiece Instruments 2023 #MasteroftheTrade Scholarship Recipients Announced at SkillsUSA National Leadership & Skills Conference

Elon Musk says monkeys implanted with Neuralink brain chips were ‘close to death’