Zoom Ends No-Meeting Wednesday Policy, Calling It ‘Barrier to Collaboration’

Zoom Video Communications Inc. has nixed its policy forbidding internal meetings on Wednesdays, saying it hindered collaboration, a

2023-08-11 00:48

EU says Google abused dominant positions in online ads

The European Commission accused Google on Wednesday of abusing its dominance of the online ad market and recommended the US company sell part of its...

2023-06-14 19:46

Singapore’s Building Technology It Needs for a New Climate Era

Singapore has gone from a mudflat swamp with fishing villages to an island metropolis boasting one of the

2023-08-02 01:16

Justin Trudeau went to see Barbie and 'fragile' men are absolutely raging

Canadian prime minister Justin Trudeau shared a photo of himself and his son Xavier attending a showing of Barbie to social media, and men are absolutely rattled. Thousands of users responded to the tweet with a range of insults, with some suggesting that it makes Trudeau unfit to be a world leader, all because he went to see one the highest-grossing films of the year. Sign up to our free Indy100 weekly newsletter One user called him a "man-child" while Charlie Kirk, the founder of the conservative organisation Turning Point USA, decided to mention Trudeau's recent announcement about his split from his wife: Charlie Kirk, the founder of the conservative organisation Turning Point USA, decided to mention Trudeau's recent announcement about his split from his wife: Scrolling through reactions to the post it wasn't hard to find lots of fragile men struggle to comprehend a man wearing pink: Andrew Tate took a slightly more satanic tone with his reaction: Some even believed Trudeau was gay and that his 15-year-old son was actually his boyfriend: Many criticised the replies, calling the men fragile and homophobic: Have your say in our news democracy. Click the upvote icon at the top of the page to help raise this article through the indy100 rankings.

2023-08-08 00:25

Is Adin Ross' luxurious chain fake? Kick streamer acquires jewelry allegedly worth $1.5M, trolls say it 'looks plastic and trash'

A fan account of Adin Ross shared a video of Adin Ross' alleged custom-designed new diamond-studded chain and pendant set that costs $1.5 million

2023-08-27 17:46

Bitcoin falls 7.2% to $26,634

Bitcoin dropped 7.2% to $26,634 at 21:45 GMT on Thursday, losing $2,067 from its previous close. Bitcoin, the

2023-08-18 06:28

Zebra Technologies Introduces Zebra Pay™ Enterprise-Grade Mobile Payment Solution

LINCOLNSHIRE, Ill.--(BUSINESS WIRE)--Sep 19, 2023--

2023-09-19 20:22

New telescope reveals stunning images of the universe as it has never been seen before

The Euclid space telescope has revealed its first full-colour images, showing the universe as it has never been seen before. The five images, taken by the European Space Agency’s newly launched flying observatory, show the shining lights of distant galaxies. Scientists hope they will also prove useful in better understanding those galaxies, which includes some of the most massive structures in the known universe. Many of the galaxies have never been seen before. And much of the information in them could help explain mysteries such as dark energy and the expansion of the universe. The images released on Tuesday include one of the Perseus cluster of galaxies which shows 1,000 galaxies belonging to the cluster, and more than 100,000 additional galaxies further away in the background. Many of these faint galaxies were previously unseen, and some of them are so far that their light has taken 10 billion years to reach us. Another image captures the spiral galaxy IC 342, nicknamed the Hidden Galaxy, because it is difficult to observe as it lies behind the busy disc of our Milky Way, and so dust, gas and stars obscure our view. One of the new pictures is of globular cluster NGC 6397 - the second-closest globular cluster to Earth, located about 7,800 light-years away. Globular clusters are collections of hundreds of thousands of stars held together by gravity. These faint stars tell us about the history of the Milky Way and where dark matter is located. To create a 3D map of the universe, Euclid will observe the light from galaxies out to 10 billion light-years. The first irregular dwarf galaxy that Euclid observed is called NGC 6822 and is located just 1.6 million light-years from Earth. And the fifth image shows a panoramic and detailed view of the Horsehead Nebula, also known as Barnard 33 and part of the constellation Orion. Scientists hope to find many dim and previously unseen Jupiter-mass planets in their celestial infancy, as well as young brown dwarfs and baby stars, in this new observation. Professor Carole Mundell, ESA director of science, said: “Dark matter pulls galaxies together and causes them to spin more rapidly than visible matter alone can account for; dark energy is driving the accelerated expansion of the universe. “Euclid will for the first time allow cosmologists to study these competing dark mysteries together. “Euclid will make a leap in our understanding of the cosmos as a whole, and these exquisite Euclid images show that the mission is ready to help answer one of the greatest mysteries of modern physics.” Rene Laureijs, the ESA’s Euclid project scientist, said: “We have never seen astronomical images like this before, containing so much detail. “They are even more beautiful and sharp than we could have hoped for, showing us many previously unseen features in well-known areas of the nearby universe. “Now we are ready to observe billions of galaxies, and study their evolution over cosmic time.” Euclid was launched on a SpaceX Falcon 9 rocket from Cape Canaveral in Florida on July 1. Named after the ancient Greek mathematician Euclid, the two-tonne probe made its way towards an area in space known as the second Lagrange point, where the gravitational forces of Earth and the sun are roughly equal - creating a stable location for the spacecraft. The UK has contributed £37 million towards the £850 million mission, with scientists playing key roles in designing and building the probe and leading on one of the two scientific instruments on board. Dr Caroline Harper, head of space science at the UK Space Agency, said: “These first colour images showcase Euclid‘s enormous potential, giving us incredibly sharp images of galaxies and stars, and helping us understand more about the impacts of dark matter and dark energy on the universe. “The UK has played an important role in the mission, leading on the development of the visible imager (VIS) instrument and on key elements of the data processing pipeline, funded by the UK Space Agency. “And this is just the start - UK researchers will be using Euclid data for many years to come to make significant new scientific discoveries about the composition and evolution of the cosmos.” Additional reporting by Press Association Read More Euclid space telescope releases first full-colour images of cosmos First full-colour images of universe captured by Euclid telescope revealed Watch again: ESA reveals first full-colour images of ‘dark universe’ from Euclid Tim Peake: Possibility of all-UK space mission a ‘very exciting development’ Strange purple light phenomenon ‘Steve’ spotted across UK skies Nasa sending VR headset up to ISS to treat astronaut’s mental health

2023-11-08 03:29

You can ask Windows 11 AI for info inside your phone's texts. Here's how it works.

Microsoft debuted a cornucopia of goodies at the Surface event on Thursday, including the Surface

2023-09-23 18:22

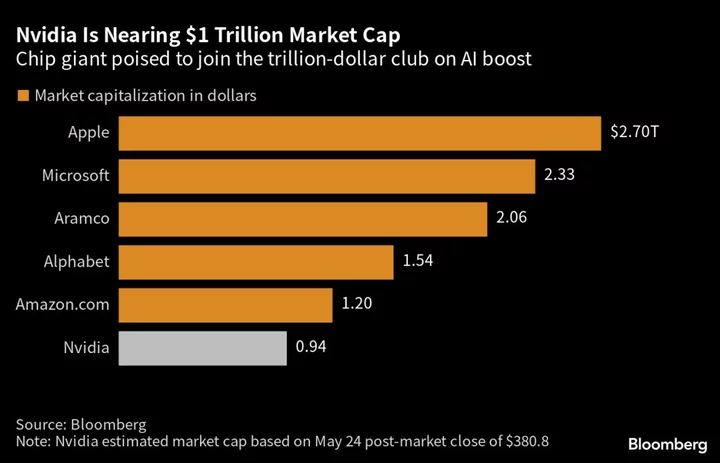

Nvidia’s Surge Sharpens Focus on Hunt for AI Losers

Nvidia Corp.’s blowout sales forecast puts a fresh emphasis on the latest game in town: identifying artificial intelligence

2023-05-25 22:19

Elon Musk reacts angrily to criticism for giving in to governments’ Twitter censorship demands

Twitter boss Elon Musk, who has often touted himself as a champion of free speech, said he had no "actual choice" when accused of caving in to censorship demands made by authoritarian governments. Since the billionaire's takeover in October last year, Twitter has approved 83 per cent more censorship requests from governments such as Turkey and India, El Pais reported. The company reportedly received 971 requests from governments, fully acceding to 808 of them and partially acceding to 154. The year prior to Mr Musk taking control, Twitter agreed to 50 per cent of such requests, which was in line with the compliance rate indicated in the company’s last transparency report. The report, shared by Bloomberg columnist Matthew Yglesias, evoked an angry reaction from Mr Musk. Mr Yglesias tweeted the report with the caption "I’m a free speech absolutist", quoting the Twitter boss. The world's second-richest person shot back, writing: "You're such a numbskull. Please point out where we had an actual choice and we will reverse it." The columnist responded: "Look, I’m not the one who bought Twitter amidst a blaze of proclamations about free speech principles. "Obviously you’re within your rights to run your business however you want." Mr Musk has repeatedly reiterated his backing for free speech both before and since the $44bn acquisition of Twitter. The “absolutist” quote refers to a tweet in March 2022 in the wake of Vladimir Putin’s unprovoked invasion of Ukraine. "Starlink has been told by some governments (not Ukraine) to block Russian news sources. We will not do so unless at gunpoint," Mr Musk tweeted. "Sorry to be a free speech absolutist." Yet Twitter has been accused of helping incumbent Turkish president Recep Tayyip Erdogan stifle criticism by blocking several accounts in the two days before the country’s hotly contested general election. “In response to legal process and to ensure Twitter remains available to the people of Turkey, we have taken action to restrict access to some content in Turkey today,” Twitter’s global government affairs announced, without explaining which tweets would be blocked. Following severe criticism, Mr Musk alleged Twitter has “pushed harder for free speech than any other internet company, including Wokipedia”. Earlier this year in India, Twitter complied after Narendra Modi’s government used emergency powers to ban content related to a BBC documentary on social media. The two-part documentary included a previously unpublished report from the UK Foreign Office that held Mr Modi “directly responsible” for the “climate of impunity” that enabled communal violence in Gujarat state. The riots in February 2002 killed over 1,000 people – most of them Muslims – while Mr Modi was chief minister of the state. Justifying the consent Mr Musk said: "The rules in India for what can appear on social media are quite strict, and we can’t go beyond the laws of a country." He said doing so would put his staff at risk. “If we have a choice of either our people going to prison or us complying with the laws, we will comply with the laws.” Read More Elon Musk tweets quote by neo-Nazi wrongly attributed to Voltaire Erdogan declared winner of Turkey presidential run-off – extending his 20 years in power India uses emergency powers to ban anyone from sharing clips of BBC Modi documentary Elon Musk tweets quote by neo-Nazi wrongly attributed to Voltaire Elon Musk’s Neuralink brain chip company gets FDA approval for human testing AOC jokes more people watched her gaming online than listened to DeSantis launch

2023-05-29 13:21

Facebook reveals new logo to ‘make F stand apart’ – but can you tell the difference?

Meta is revamping Facebook’s logo to a darker blue with a few small tweaks to create what it claims is a “bolder, electric and everlasting” design. The “subtle” logo change – which at first glance may seem barely noticeable – incorporates a “more confident expression of Facebook’s core blue color,” the social media company said in a blog post. Facebook says the logo change to the lowercase “f” is more visually accessible in the platform’s app with “stronger contrast for the ’f’ to stand apart”. “We wanted to ensure that the refreshed logo felt familiar, yet dynamic, polished and elegant in execution. These subtle, but significant changes allowed us to achieve optical balance with a sense of forward movement.” Dave N, director of design at Facebook said. The social media giant highlighted three “key drivers” behind the evolution of its logo, including a push to “elevate the most iconic elements” of the brand, and to create “an expansive set of colors” anchored in blue. Over the years, the social media platform’s logo has undergone a number of changes, starting from one that had square boundaries to the current circular design. The new logo, the company says, uses its custom typeface – Facebook Sans – and a redesigned wordmark and logo to “create a consistent treatment and improve overall legibility.” The new design has led to some being left puzzled on social media. Some users, however, described the design changes in a little more detail. Facebook says it has also developed a new colour palette with a new set of hues, tones and contrast ratios. “The deep tonal range of secondary blues allows for flexibility while providing balance as a single expression of our brand identity,” the company said. It said more changes to the platform’s “reactions, typography and iconography” are to be rolled out in the future. “All of these refinements will create a more consistent, personal and seamless experience for the billions of people who interact with Facebook daily,” the company said. Meta likely has more changes planned for the brand’s design in the coming days, with the company describing the latest tweaks on Wednesday’s blog as “the first phase of a refreshed identity system” for the app. Read More Meta’s encryption plans will create ‘safe haven’ for paedophiles, Braverman says Elon Musk warns of ‘civilisational risk’ posed by AI at historic gathering of tech giant chiefs Twitter rival Threads’ launch of much-anticipated feature did little to attract more users, data suggests What is ‘Rumble’, where Russell Brand is posting videos? Google sued after man drove off collapsed bridge while following map directions Google’s powerful ‘Bard’ AI can now get into your email

2023-09-21 14:46

You Might Like...

A hidden underground ocean could be causing ‘slow-motion' earthquakes

MTG Lord of the Rings: Tales of Middle Earth Amass Orcs Mechanic Explained

American soldiers brought breakdancing to South Korea. Now it's writing its own history

Leonardo's air booking system resumes after cyberattack - state company Rostec

Olivia Dunne sizzles in black bikini as she shares polaroids from Malibu

EU Still in Talks With Countries on Renewables Deal

Amouranth slams Twitch for its 'sin' after Kick move, fans call it 'worst discoverability'

Australia Hydrogen Startup Hysata Taps Morgan Stanley for Funding Round