Chinese tech entrepreneurs keen to 'de-China' as tensions with US soar

By David Kirton SHENZHEN, China For the ambitious Chinese tech entrepreneur, expanding into the U.S. just keeps getting

2023-05-31 08:29

X's $100 million a year 'Promoted Accounts' ad feature is no more

Are you still advertising on X, the Elon Musk-owned social media platform formerly known as

2023-08-16 04:24

Microsoft Teams down: Office chat app not working in the middle of the working day

Microsoft Teams, the popular workplace chat app, has gone down in the middle of the working day. Users complained that they were unable to get online or talk to colleagues in what appeared to be a widespread outage. But soon after the problems were identified, many appeared to be able to get back online again. The problems began around lunchtime in the UK, and around the time that many in the US are beginning work, according to tracking website Downdetector. Numerous users complained on that site and elsewhere that they were unable to get online, particularly using their browser. Many of those users were hit by a mysterious message reading: “Operation failed with unexpected error”. Others saw similarly vague messages about not being able to connect to the internet or indistinct error codes. Microsoft confirmed on its official account that it was aware of an issue where “some users may be unable to access Microsoft Teams using web browsers”. But numerous users complained that they were unable to get online through the desktop app, either.

2023-06-28 21:50

Tiny solar-powered van unveiled in Japan

A Japanese automaker has unveiled an electric van that uses rooftop solar panels to charge its battery. The Puzzle van, built by HW Electro, is designed to be disaster resilient, capable of functioning during periods of prolonged power outages, however its small size and limited power output means many everyday users could operate it without ever needing to plug it in. The pint-sized van comes with three photovoltaic panels, emergency outlets, an inbuilt first aid kit, WiFi internet connectivity, and a crowbar. HW Electro said the puzzle-inspired design allows its components to fit together in a cost-effective way, making it suitable for “emergencies and for daily convenience” alike. The Puzzle is a type of ‘kei car’, which are smaller and lighter than regular vehicles in order to attain tax and insurance benefits within Japanese regulations. For the first time, HW Electro will be selling a kei car in the US, with commercial sales set to begin in 2025. “The Puzzle launch marks HW Electro’s dedication to addressing environmental challenges and creating innovative eco-friendly solutions to the commercial vehicle market,” HW Electro President Hsiao Weicheng said at the van’s unveiling. “We are excited to officially showcase Puzzle today and we look forward to making it available in the US market.” HW Electro is yet to reveal details about the price or top speed, though its form and functionality could meet a growing demand in the US for small electric vehicles. Areas like Arizona and Florida are increasingly seeing families using electric golf carts as a “second car”, capable of making short trips within a town. Some states are even adapting laws to allow small electric vehicles with limited top speeds to be driven on public roads, according to Electrek. “As the trend continues to grow, it promises not just a transformation of our local communities, but also a greener and more sustainable future for all,” the publication noted in August.

2023-11-22 23:46

Fabric’s Innovative Automated Fulfillment Solution Wins Two Prestigious Honors

NEW YORK--(BUSINESS WIRE)--Jun 19, 2023--

2023-06-19 19:15

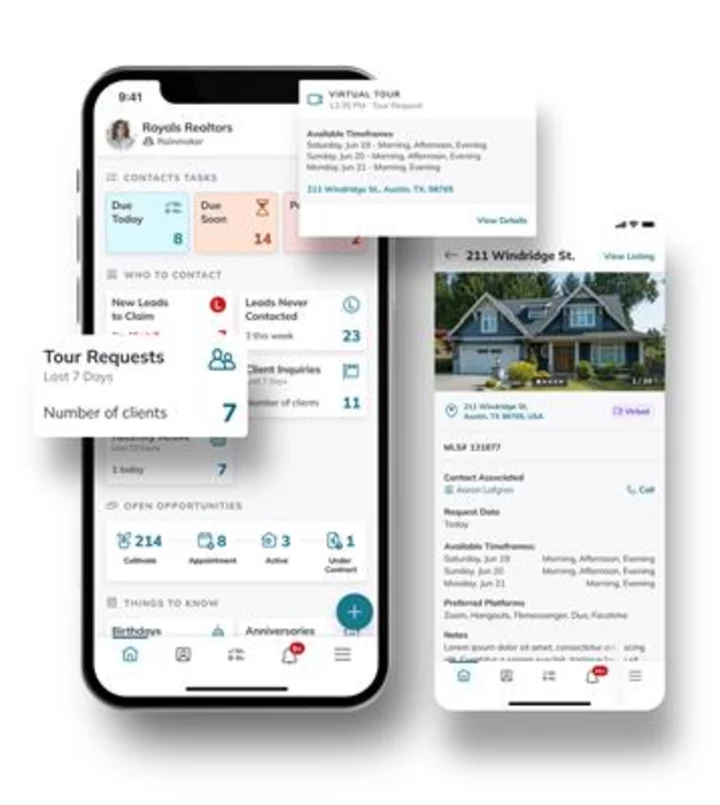

Keller Williams Fuels Agent Businesses with Technology Enhancements

AUSTIN, Texas--(BUSINESS WIRE)--Jun 13, 2023--

2023-06-14 00:52

OpenAI, Jony Ive in talks to raise $1 billion from SoftBank for AI device venture - FT

(Reuters) -ChatGPT maker OpenAI is in advanced talks with former Apple designer Jony Ive and SoftBank's Masayoshi Son to build

2023-09-28 22:24

Verizon Starts Testing of Potential Lead Contamination Sites

With its shares tumbling to their lowest in 13 years, Verizon Communications Inc. is launching an investigation to

2023-07-18 05:50

Did Jason Oppenheim and Marie-Lou get married? 'Selling Sunset' stars' latest pics spark wedding speculations

Fans were left baffled after Jason Oppenheim and Marie-Lou shared some stunning photos which seemed as if they got married

2023-05-20 15:51

‘Being Young’ a Short Documentary Presented by Nissan to Debut on ESPN+

NASHVILLE--(BUSINESS WIRE)--May 26, 2023--

2023-05-26 19:29

Amazon Prime Video will soon come with adds, or a $2.99 monthly charge to dodge them

Amazon’s Prime Video will begin showing adds during shows and movies early next year, joining other streaming services that have added different tiers of subscriptions

2023-09-22 19:27

How to Unlock Zombie Ghost Operator in Warzone

Players can unlock the Zombie Ghost Operator in Warzone by pre-ordering the digital version of Call of Duty: Modern Warfare 3.

2023-09-22 00:49

You Might Like...

Infineon and SolarEdge Sign Multi-Year Capacity Reservation Supplier Agreement to Foster Green Energy Solutions

Best Tempus Razorback Build in Warzone 2 Season 5

Watchdog Probes More Than 100 Australian Firms on Greenwashing

Riot Games Partners With Coca-Cola to Launch League of Legends Inspired Drink

'Reminds me of Mixer': Pokimane opens up about Twitch streamers moving platforms as she returns from hiatus

Musk launches xAI to rival OpenAI, Google

The end of annoying CAPTCHAs? Web browsers will soon help users skip them

Chinese Used ByteDance ‘God Credential’ to Track Data, Suit Says