AI generated modern Mona Lisa slammed for catering to the 'male gaze'

As artificial intelligence has become a bigger part of the cultural conversation many have used its power to create art, a subject that’s been highly controversial amongst artists who accuse AI of stealing and profiting of their work. The most recent AI art to go viral is a depiction of what Da Vinci’s iconic Mona Lisa would look like today, and the result is… interesting. The AI version showed a lot of changes. Clearer sing, wide eyes, a bit of makeup and a lot of cleavage. Many men seemed suddenly attracted this version of Mona Lisa leaving comments such as “now I’m interested in art” and “would” about a non-existent version of the famous woman. Sign up to our free Indy100 weekly newsletter But many were critical of the picture. “Y’all notice how ai art is very much catered to target the male gaze…” commented one user. One user said the image was “a very funny illustration of AI bias,” and that this other Mona Lisa “makes a starker point about AI and art.” He goes on to say that, “real art challenges or re contextualises - it is an act of original thought. “Most AI tools can only please. They cannot subvert or invent unless so programmed.” Many seemed to agree with one tweet amassing over 80,000 likes for critiquing the image saying: "not this what she would like like according to porn addicts." Another user joked about what the actual Mona Lisa looks like today: The creator of the image Gianpaolo Rosa has addressed the controversy surrounding the image claiming that it was made to "honour Leonardo Da Vinci's masterpiece" but regonised that the sexualisation of women is "sad" and "problematic" but hopes that the image can open a dialogue about how we "perceive art and women." AI art has long faced criticism and many argue that it often shows AI's limitations, rather than its capabilities. Many say it lacks originality and creativity, often producing work after being 'fed' the real work of artists. Harry Woodgate, author and illustrator of Grandad's Camper, said to The Guardian in January: "These programs rely entirely on the pirated intellectual property of countless working artists, photographers, illustrators and other rights holders." Have your say in our news democracy. Click the upvote icon at the top of the page to help raise this article through the indy100 rankings.

2023-08-01 00:54

Take-Two's CEO: GTA 6 needs to be 'nothing short of perfection'

The Take-Two Interactive spoke about the challenge Rockstar Games faces to get the game perfect.

2023-05-25 20:26

Google removes 'Slavery Simulator' game from store following a wave of criticism in Brazil

A game entitled "Slavery Simulator," where players can "buy and sell" enslaved Black characters, was taken down from Google's app store after widespread criticism from Brazilian social media users.

2023-05-26 02:55

Wesleyan University: Top US college says it will end 'legacy' admissions

The university says it is "important" to end the policy, seen as a perk for the white and wealthy.

2023-07-19 23:58

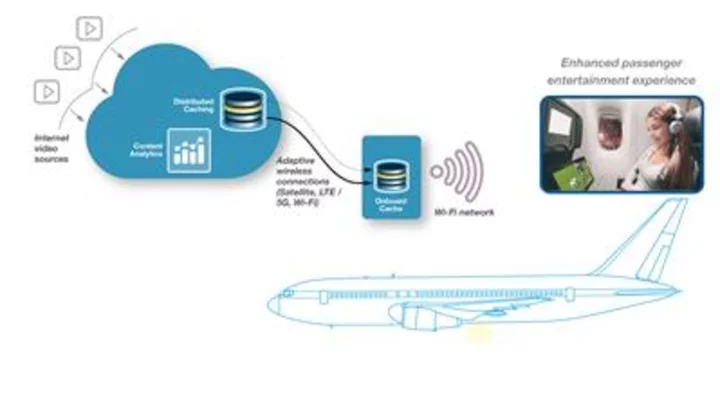

Thales and Netskrt Systems Working Together to Enhance the Passenger On-Demand Video Streaming Experience

VANCOUVER, British Columbia--(BUSINESS WIRE)--Jun 6, 2023--

2023-06-06 22:24

Pac-Man 99 removed from Nintendo Switch Online

‘Pac-Man 99’ has been removed from Nintendo Switch Online after the company confirmed that it intended to take down the game earlier this year.

2023-10-11 00:25

Exclusive - EU antitrust regulators to okay Broadcom, VMware deal, sources says

BRUSSELS EU antitrust regulators are set to approve with conditions U.S. chipmaker Broadcom's $61 billion proposed acquisition of

2023-06-12 17:21

Zeitview Expands Services in Europe with Crewed Aircraft Solar Inspections

MUNICH--(BUSINESS WIRE)--Jun 14, 2023--

2023-06-14 12:23

Huawei’s Mate 60 Pro Phone Shows Large Step Toward Made-In-China Parts

Huawei Technologies Co.’s Mate 60 Pro smartphone employs an unusually high proportion of Chinese parts, in addition to

2023-09-08 06:16

IBM unveils new watsonx, AI and data platform

By Jane Lanhee Lee OAKLAND, California International Business Machines Corp on Tuesday launched watsonx, a new artificial intelligence

2023-05-09 18:26

X CEO Linda Yaccarino says company is still watching Threads competition

X CEO Linda Yaccarino, leader of the platform formerly known as Twitter, said the company is keeping an eye on new competitor Threads, despite the sharply slowing growth of the rival app from Meta.

2023-08-11 00:48

Tristan Tate shares his thoughts as Kai Cenat's reaction to Doja Cats' 'Demons' leaves fans ROLFING

Kai Cenat and Tristan Tate humorously satirized the 'Demons' music video by Doja Cat to express his feelings

2023-09-05 17:55

You Might Like...

VW to test self-driving tech in retro-styled electric Microbuses

Apple's Game Porting Toolkit Can Run Cyberpunk 2077, Diablo IV Over a Mac

Canada’s Wildfires Have Spewed More CO2 Than Mexico Did in a Year

Bitcoin steadies above $25,000 as Binance SEC lawsuit rattles investors

Why Do We Tilt Our Heads When Being Photographed?

‘Miracle material’ solar panels to finally enter production in China

The MGM Resorts website is offline due to a cybersecurity issue

Twitch streamer Puppers, who lived with MND, dies aged 32