India Clashes With Twitter Ex-CEO Dorsey Over Removal of Posts

The Indian government fired back at Twitter Inc.’s former chief executive officer after he said authorities had threatened

2023-06-13 17:17

Fed’s Waller Says Climate Change Doesn't Pose Serious Financial Risk

Federal Reserve Governor Christopher Waller said there’s no need for central bankers to pay special attention to risks

2023-05-11 22:55

Nintendo is taking 3DS and Wii U offline within six months

Nintendo 3DS and Wii U will both be offline online by April 2024.

2023-10-05 19:55

Logitech MX Anywhere 3S Review

The $79.99 Logitech MX Anywhere 3S is an update to the company's excellent Anywhere 3,

2023-05-31 19:51

How to download songs from Spotify

One of the benefits of Spotify Premium is that users can download their favorite songs,

2023-07-22 17:51

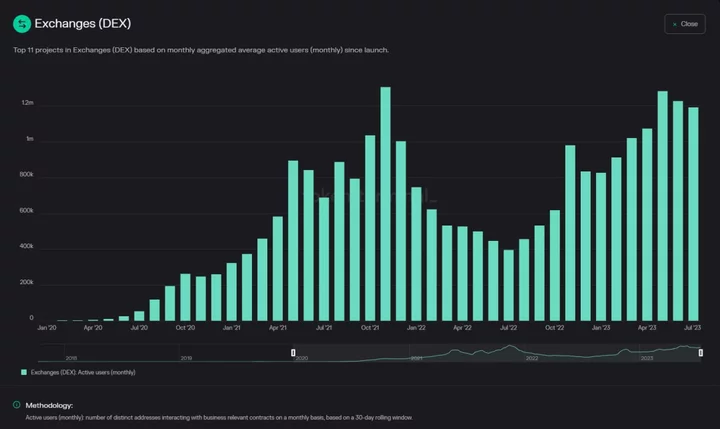

Crypto’s Peer-to-Peer Exchanges Lose Ground in a Shrunken Market

Crypto exchanges that connect buyers and sellers directly without Wall Street-style middlemen are under pressure to improve their

2023-07-23 22:25

Overtime Megan: TikTok star whose private pics leaked online graduates

TikTok star and sports reporter Megan Eugenio recently posted videos from her graduation ceremony

2023-05-16 18:46

Prep for CompTIA certifications with this $50 training course bundle

TL;DR: Study for a dozen different IT certification exams with the Complete 2023 CompTIA Certification

2023-07-19 17:52

Dollar General Literacy Foundation Donates $1 Million to Dolly Parton’s Imagination Library®

GOODLETTSVILLE, Tenn.--(BUSINESS WIRE)--Aug 2, 2023--

2023-08-03 05:19

Harris targets Florida rules on Black history pushed by DeSantis

Vice President Kamala Harris will swipe at new standards for teaching Black history in Florida during a trip to Jacksonville

2023-07-22 00:55

Fast Fashion’s Slow Adoption of New Fibers Puts Green Targets At Risk

Retailers like Hennes & Mauritz AB and Inditex SA are buying only “peanut quantities” of an innovative fiber

2023-11-08 22:56

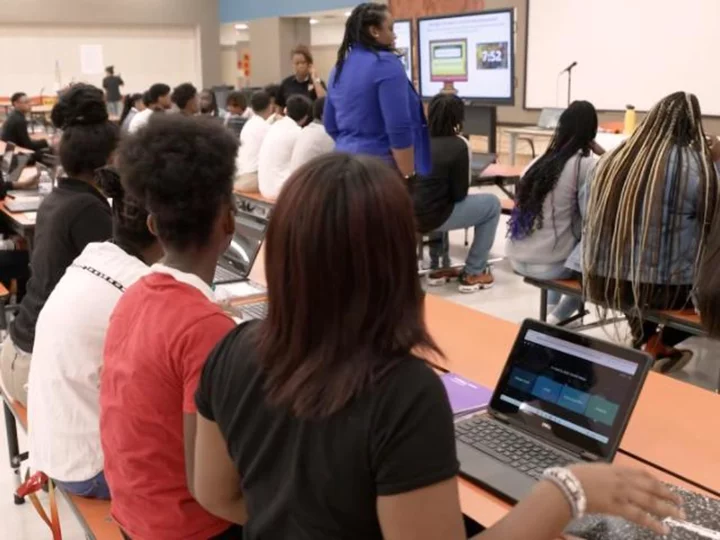

Doubling up on classrooms, using online teachers and turning to support staff: How schools are dealing with the ongoing teacher shortage

Millions of students are returning for another school year marked by challenging teacher shortages, causing schools to double up classrooms, move courses online and employ what critics have labeled as underqualified teachers.

2023-09-11 20:47

You Might Like...

Score this mini body camera on sale for just $38

TotalEnergies Plans Jumbo Green Hydrogen Tender to Cut Emissions

How to watch Google I/O 2023 live

Grand Theft Auto 6 hacker deemed unfit to stand trial by psychiatrists

Amid protests, Reddit seeks to force subreddits to reopen

Comcast Announces $250,000 Grant to Fund Digital Navigators at 26 Chicago Public Library Branches, Plans to Donate 1,000 Laptops to 10 City Non-profits

Accenture Federal Services Wins $98M Defense Health Agency Award

Elon Musk must face fraud lawsuit for disclosing Twitter stake late