Just as Micron Technology Inc. investors were starting to glimpse the end of a painful demand slump, the Chinese government is making the recovery path murkier.

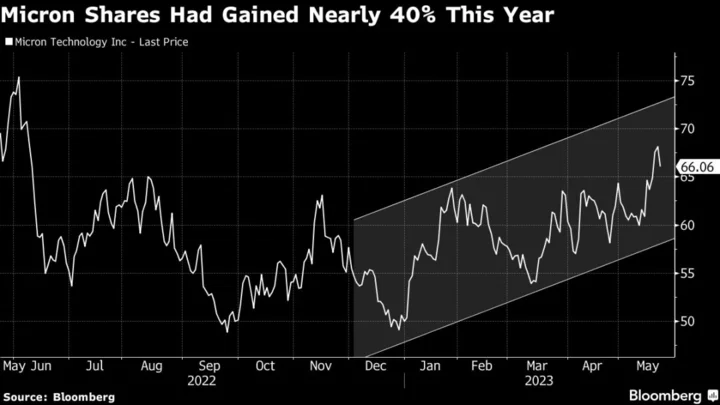

The largest US maker of memory chips had rallied nearly 40% this year amid optimism that the worst is over after a series of supply cuts aimed at restoring equilibrium amid a drop in sales of personal computers and other devices. Now, restrictions in China threaten to throw a wrench into Micron’s recovery and potentially aid rivals like South Korea’s SK Hynix Inc.

“There’s a lot of enthusiasm that we’re going to bottom out in a quarter or two and you’re going to see a recovery in Micron’s key markets,” said Daniel Morgan, senior portfolio manager at Synovus Trust Co. “This makes it that much harder for Micron to overcome that hurdle.”

While Micron only gets about a tenth of revenue directly from China, the country is home to factories that produce a large share of the world’s electronic devices, adding potential complications to the firm’s supply chain and customer relationships.

So far, investors aren’t hitting the panic button. Micron shares fell less than 3% on Monday, paring a drop of as much as 5%, after China said the firm’s products failed to pass a cybersecurity review and warned operators of key infrastructure against buying its goods. SK Hynix rose 0.9% on Monday.

Most analysts on Wall Street expect China’s move to affect only a portion of Micron’s sales in the country because it’s currently limited to “critical information infrastructure” and most of the firm’s chips are destined for electronics like mobile phones and personal computers.

Micron estimates China’s actions will reduce total revenue by a low-single to high-single digit percentage, Chief Financial Officer Mark Murphy said in remarks at an investor conference on Monday. About a quarter of revenue, in the form of direct and indirect sales through distributors, comes from China-headquartered companies, he said.

For Stifel analyst Brian Chin, Monday’s news was enough to lose conviction in a call made last month that the stock was due for a 10% to 20% rally based on improving sentiment about supply and demand dynamics in the memory market.

“Given the unfavorable conclusion of the review, we believe the short-term trade here has concluded,” Chin wrote in a note on Monday.

Up until now, the trade had worked well. Micron’s 12% gain last week was its best since January after Bloomberg News reported the company is poised to land about $1.5 billion of financial incentives from the Japanese government to make next-generation memory chips.

Micron is striving to turn around its business after two consecutive quarters of net losses. It provided better-than—expected sales guidance for the third quarter, on the back of improving supply-demand balance in the global chip glut and more job cuts.

Optimism about the second half of the year had helped lift the stock’s valuation to 3.7 times projected revenue for the next 12 months from a low of about 1.5 times in June 2022, according to data compiled by Bloomberg.

Tech Chart of the Day

Nvidia shares have more than doubled this year, putting them within touching distance of their record closing high of $333.76. The stock, which has benefited from the artificial intelligence frenzy that has gripped Wall Street, is the top-performing component in both the S&P 500 and Nasdaq 100 indexes this year. The rally has paused in recent days, with the chipmaker’s stock falling for third straight session on Tuesday.

Top Tech Stories

- Amazon.com Inc. repeatedly violated federal labor law by unilaterally changing policies and terminating union supporters at its sole unionized warehouse, US labor board prosecutors alleged in a complaint, which also accuses Chief Executive Officer Andy Jassy of personally making illegal anti-union comments.

- TikTok will “soon” grant Oracle Corp. full access to its source code, algorithm and content-moderation material as part of efforts to alleviate national security concerns about the app.

- Zoom Video Communications Inc. raised its full-year sales forecast in a positive sign for the software maker’s effort to continue growing in a post-pandemic world.

- Singapore is benefiting from the US-China discord in at least one respect: semiconductor sales.

- Yelp shares surged following the Wall Street Journal’s report that an activist investor has called for the company to look into a sale and other strategic options.

--With assistance from Charlotte Yang and Subrat Patnaik.

(Updates to add index move to Tech Chart of the Day section.)