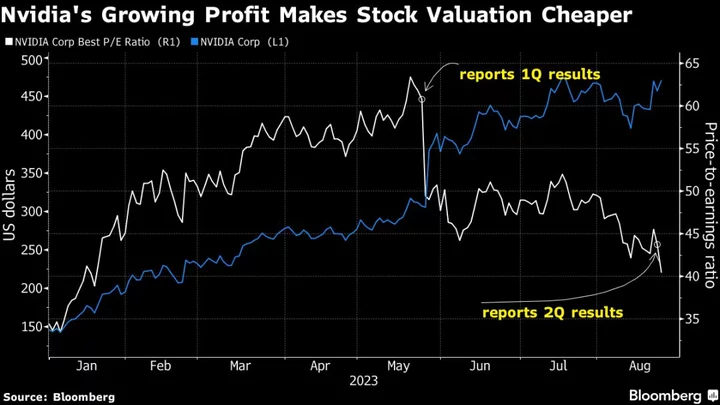

Investor concerns about Nvidia Corp.’s scorching valuation are being eased every time the chipmaker reports earnings.

That’s because its forecasts have dwarfed Wall Street projections by so much that estimates used to value the stock have risen faster than Nvidia’s shares. Its price relative to projected profits has fallen to about 40 times after it delivered its latest eye-popping projection on Wednesday. That’s down from 63 times before its May earnings report.

“There have been questions about whether Nvidia would grow into its valuation, and now it seems like there’s a decent chance it will,” said Michael Kirkbride, portfolio manager at Evercore Wealth Management. “This is not crazy expensive, given the kind of extraordinary growth we’re seeing.”

Nvidia’s rapid expansion supports an argument bulls have been making all year to justify lofty valuations for tech giants: that the companies will deliver bigger profits than contemplated in current estimates, thereby making them cheaper than they appear. Of course, no other megacap is expected to come even remotely close to keeping up with Nvidia when it comes to growth.

To be sure, the firm at the forefront of an industrywide artificial intelligence race still isn’t cheap. It trades well above the multiples of other technology giants such as Apple Inc., Microsoft Corp. and Meta Platforms Inc. The Nasdaq 100 index trades at around 24 times expected earnings.

Having become the first-ever semiconductor company to rack up a $1 trillion market valuation after another blowout quarter in May, investors had sought evidence that the second quarter was not just a one-time spike. Its earnings Wednesday were more bullish than hoped for.

The $13.5 billion in revenue that Nvidia delivered in the quarter was more than twice as much as sales in the same period a year ago. Even Tesla Inc., whose profits are projected to shrink this year in contrast with Nvidia’s, saw revenue expand at less than half Nvidia’s clip in the second quarter.

But with the shift to AI seen as only beginning, the bet is that the company can continue to grow into its valuation. Its decision to authorize an additional $25 billion in share repurchases has also given bulls another reason to cheer.

“This separates Nvidia from an entrepreneurial startup,” said Quincy Krosby, chief global strategist at LPL Financial. “This is a mature company and you need to see that in this kind of period of business development.”

Tech Chart of the Day

Faced with skyrocketing demand for its processors, Nvidia more than doubled its revenue in the reported quarter. The semiconductor company’s growth rate is by far the fastest among Nasdaq 100 peers. Electric-vehicle companies Lucid Group Inc. and Tesla Inc. are in second and third position, but their revenue growth is about half that of Nvidia.

Top Tech Stories

- Nvidia acknowledged that the US may impose stronger restrictions on the sale of chips to China and warned that such a move will hurt American companies in the long term, reiterating a broadly held view among top chipmakers.

- Meta Platforms Inc., Google and X, formerly known as Twitter, will need to adhere to strict new content moderation rules in the European Union when a new law governing social media platforms becomes legally enforceable from Friday.

- Snowflake Inc. gave a sales outlook for the current quarter in line with expectations, suggesting that companies are still cautious about expanding their cloud software budgets.

- VinFast Auto Ltd.’s head-scratching surge has given the money-losing electric car startup a bigger market capitalization than Citigroup Inc., with famed short seller Jim Chanos calling the stock’s valuation “insane.”

- Meituan posted its fastest pace of revenue growth since 2021, after dining and travel bounced back from Covid-Zero depths despite broader consumer spending malaise.

- Internet startup VNG Ltd. filed for an initial public offering in the US, making it the first Vietnamese technology company to seek a listing in New York and adding to a diversifying roster of companies planning listings as equity markets thaw.

Earnings Due Thursday

- Premarket

- Netease

- Postmarket

- Intuit

- Workday

- Marvell

--With assistance from Subrat Patnaik and Tom Contiliano.