Just a few years ago, tech evangelists were hailing Niantic Inc., the maker of the hit game Pokémon Go, as proof of the metaverse’s vast and growing business potential. But now, following the lackluster debut of yet another augmented-reality game, Niantic is looking like something else — more evidence of the metaverse’s vast and growing business woes.

On May 9, the San Francisco-based, closely held software maker launched Peridot, a free, pet-simulator game for mobile phones that aims to blend the digital and physical worlds into what the company has called the “real-world metaverse.” After downloading the Peridot app, players hatch a unique Dot and give their new digital pet a name. Using the phone’s camera lens, the game then superimposes one’s pet on whatever real-world vista the user points their phone at, say, a patch of grass in their backyard. From there, the Dot can run through the phone’s view of the yard, chasing tennis balls, digging up treats and interacting with the objects around them as they gain capabilities and grow.

Despite much furball cuteness and some captivating visuals, the game has so far landed with a whimper. After one week, amid a slew of negative app-store reviews, Peridot has generated 675,000 downloads from its May 9 launch through May 13, according to data from researcher Sensor Tower. Some reviewers have complained that its augmented reality is inconsistent and quickly drains the battery life from phones. Others have criticized the game’s monetization strategy around breeding Dots. The game has a 3 out of 5 rating on Google’s Play Store.

“The lukewarm response and low download numbers offers a sobering outlook on the enthusiasm around blending the virtual and the real,” said Joost van Dreunen, a lecturer at New York University’s Stern School of Business.

Niantic downplays such concerns and expresses confidence in both Peridot and the public’s appetite for augmented-reality (AR) games. “Peridot is probably the world’s first mobile game played fully in AR, and we’re just getting started,” said Mark Van Lommel, a company spokesperson. “While initial demand has exceeded our expectations, we don’t expect Peridot to be an overnight hit, and rather see it as a long-term project that will showcase the potential of AR and experimental game design.”

Questions about the future of the “real-world metaverse” have been swirling around Niantic for years.

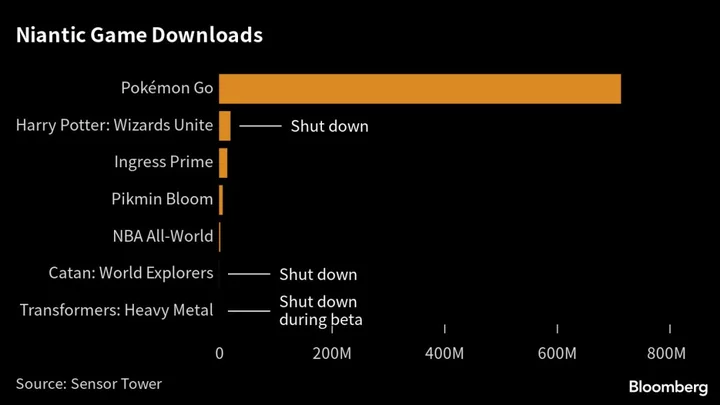

In 2016, not long after being spun off from Google, Niantic enjoyed a major cultural hit right out of the gates with the debut of Pokémon Go — a mobile game in which players wander through the real world capturing digital Pokémon that appear on their phone. The game has since been downloaded over one billion times, Niantic said. According to Sensor Tower, it has grossed $6.6 billion.

At first, Niantic’s success with Pokémon Go seemed to portend a bright future for the science-fiction-inspired industry. In the years that followed, as augmented-reality and virtual-reality (VR) games were rebranded as part of the broader “metaverse,” Niantic became a darling of the burgeoning field’s biggest boosters. Based on the notion that everyone would soon be socializing, working and doing commerce in an interconnected virtual reality, executives at Meta Platforms Inc., Microsoft Corp., Unity Software Inc., Alphabet Inc., Nvidia Corp. and a variety of Web3 companies collectively invested billions of dollars in the field.

Niantic went on to raise over $770 million in funding and acquire several tech companies, according to data from Crunchbase. The company proceeded to publish about a half-dozen mobile games that combined the basic dynamics of augmented reality on mobile phones with some well-established characters drawn from other companies’ popular entertainment universes, ranging from Harry Potter to the National Basketball Association. Peridot is the company’s first original intellectual property.

In 2021, with Silicon Valley’s excitement around the metaverse reaching a fever pitch, Niantic launched Lightship, a creative platform that would allow any game developer to follow the company’s lead, creating “real-world metaverse” apps in the style of Pokémon Go. Chief Executive Officer John Hanke said that Lightship would “set a pattern for what AR can be” and help spur the adoption of AR goggles, a technology he routinely championed.

But two years later, Lightship’s impact on the gaming industry has been minimal. So far, most of the resulting games have struggled to find an audience. There are just 50 apps in development using Lightship. To date, only one has received over 100,000 downloads on Android. Developers are more enthusiastic about Niantic’s 2022 acquisition of 8th Wall, an augmented-reality platform for the web that forms the basis for over 2,500 commercial apps, ranging from the Disneyland Paris WebXR Experience to the Moët-Hennessy Virtual Concierge.

Meanwhile, Niantic’s own AR games have been putting up similarly paltry numbers. Seven years after its launch, Pokémon Go remains the company’s only truly successful game aside from Ingress, which was published in 2012 when Niantic was still under Google’s umbrella. In 2021, the company shut down its second-most-popular title, Harry Potter: Wizards Unite, which CEO Hanke described as “mediocre.”

Niantic’s Van Lommel also noted that Pikmin Bloom, made in collaboration with Nintendo Co., has a “strong and very active community.” Last month, the company announced and started testing Monster Hunter Now, made with Capcom Co.

Many Pokémon Go fans opt out of the game’s augmented-reality features — an option some Peridot players have also requested. Van Lommel said the company has “seen a lot of Peridot players reacting with surprise and delight by how real their Dots feel, particularly by how well they recognize and interact with their real-world environments, and this type of moment can only happen in AR.” He added that “Peridot is designed to be played just a few minutes at a time, not for extended stretches like most other games” and noted that players can adjust their settings to “improve device performance at the trade off in AR quality.”

Niantic’s struggles mirror the downturn facing the broader industry. After years of hype, optimism in the business potential of the metaverse has dimmed considerably, with companies including Meta, Microsoft and Tencent Holdings Ltd. slashing their metaverse units. Across the market, AR and VR products have remained a niche — both as smartphone apps and dedicated devices. In 2022, VR headset sales even declined, according to data from NPD Group. In 2022, Meta lost $13.7 billion on AR and VR. In early 2023, few gamers are purchasing Sony’s new PlayStation VR 2. In February, Microsoft cut employees working on its Hololens AR headset.

“People might be hesitant to adopt this technology because, with your phone, you can just put it away and go outside and look at your plants and not worry about getting an AI ad for that kind of plant,” said Quinn Myers, author of Google Glass.

In early 2022, Niantic laid off 8% of its staff and canceled four projects.

“It seems that Niantic, like nearly every other tech company globally, found the problem is harder than anyone had imagined,” said Matthew Ball, CEO of venture capital firm Epyllion and author of The Metaverse. “The timeline for AR goggles and VR is longer than expected. The bar for the minimum viable product to release to the masses is a lot higher.”

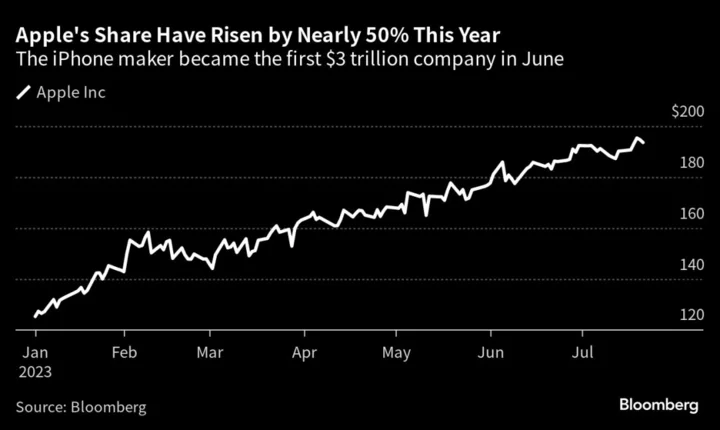

The high price of the products may also be hindering mainstream adoption. Meta’s Quest 2 mixed-reality headset costs $400 while its next-gen Pro headset costs $1,000. The coming mixed-reality headset from Apple Inc. may cost $3,000, Bloomberg reports.

Last year, Niantic announced it was teaming up with Qualcomm Inc. to create what it called an “outdoor AR headset” and released some initial renderings. So far, few details have emerged, but Van Lommel says the company continues to work on the reference design and would produce the product in partnership with other companies. In a recent demo, Niantic developers said that the company has hoped Peridot would one day be played on AR headsets.

But in the wake of Peridot’s struggles, the case for mass AR adoption looks even more far-fetched.

“These are hard products to manufacture, hard technology to produce, and it’s difficult to make games with a 3D experience,” said Ben Arnold, NPD’s consumer technology industry analyst.