Tether, the digital token that underpins much of cryptocurrency world’s ecosystem, saw its market capitalization decline for the first time in nine months amid a growing reshuffling of the stablecoin sector.

The market cap of Tether’s USDT token fell 1.2% to $82.9 billion in August, according to researcher CCData. That’s still three times larger than its closest competitor. Stablecoins are crypto tokens that are usually pegged one-to-one to an asset such as the dollar and are mostly used in trading and to move digital assets between exchanges.

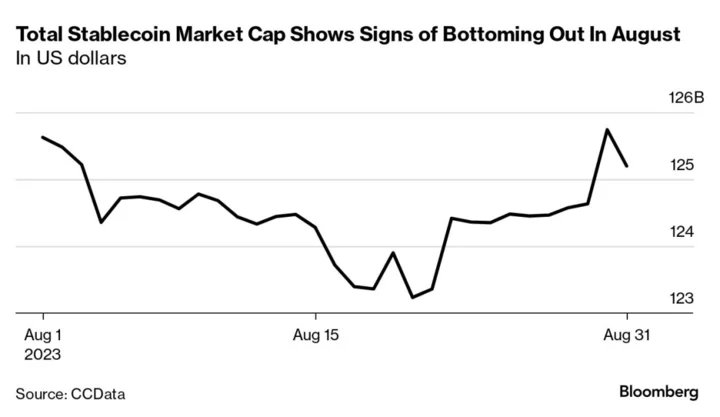

The overall size of the stablecoin universe contracted for a 17th consecutive month, dropping 0.4% to around $125 billion, CCData said. Trading volume has declined in the estimated $1 trillion digital-asset market this year with interest rates rising, regulators exerting more control and investor interest waning. Tether remains the world’s most traded cryptocurrency.

“This ongoing decline reflects not just low trading volumes on centralized exchanges but also a reduced activity in the DeFi space,” said Jacob Joseph, research analyst at CCData.

A representative for Tether, which is registered in the British Virgin Islands, didn’t return a request for comment.

The shifting market dynamics has led to pronounced changes in stablecoins. The Binance-branded BUSD stablecoin is slowly being taken out of usage, following a US regulatory crackdown. Meanwhile, Tether’s biggest competitor, Circle’s USDC token, has lost about half its market share in the past year in the wake of turmoil at Silicon Valley Bank, which held reserves for the Boston-based firm. USDC was little change in August at around $26 billion.

Meanwhile, First Digital Group’s recently introduced FDUSD stablecoin is gaining traction, thanks in part to incentives being offered to customers on the Binance exchange as it seeks to accelerate the transition from BUSD. Binance is being sued in the US by the Securities and Exchange Commission, as well as the Commodities Futures Trading Commission.

Even with the recent crypto industry turmoil, there are signs that the stablecoin sector may have bottomed out, Joseph said. The total market capitalization hit a low of $123 billion on Aug. 19 but has risen since.

“Although it is early to say if the market cap of stablecoins has finally hit a bottom, there are encouraging signs that hint at some inflow of capital,” Joseph said.

The end of August uptick follows some positive developments for the sector. PayPal Holdings Inc. announced its new stablecoin on Aug. 7. And a court ruling the same month appeared to clear the way for Grayscale to convert its Bitcoin Trust into an exchange-traded fund backed by physical Bitcoin. And overall use of stablecoins on various blockchains indicates their usage has remained “relatively stable,” said James Seyffart, an analyst at Bloomberg Intelligence.