Legal & General Investment Management is expanding the universe of assets it blacklists due to climate concerns, as it warns portfolio companies that time is running out to clean up their acts.

LGIM, the UK’s biggest fund manager with $1.5 trillion in client assets, says its exclusion list now applies to funds with almost £158 billion ($200 billion), in a statement on Thursday. Its latest divestments were from Air China Ltd. and Cosco Shipping Holdings Co., it said.

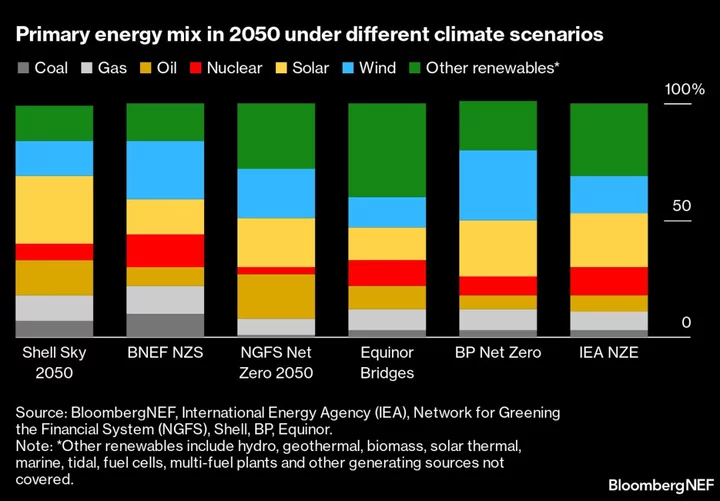

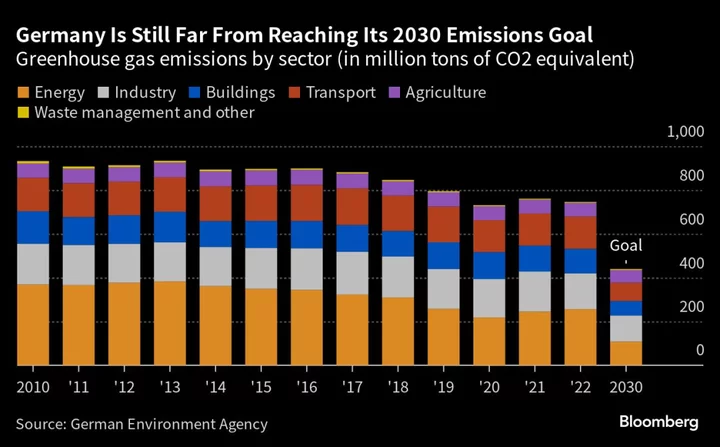

The decision comes as efforts to rein in global warming fall well short of critical thresholds identified by scientists. The window to limit temperature rises to 1.5C is “rapidly” narrowing, LGIM said, underpinning the need to revise existing investment policies and eliminate assets that are causing unacceptable levels of environmental damage.

“The transition isn’t happening fast enough,” Stephen Beer, senior manager for sustainability and responsible investment at LGIM, said in an interview. As a result, the asset manager is now “engaging in some very real-world conversations” with portfolio companies to figure out which emissions strategies aren’t good enough, he said.

Environmental, social and good governance issues are increasingly guiding the choices asset managers make. LGIM said the latest proxy season resulted in 342 companies being subject to voting sanctions because of their “poor climate change standards.” It specifically targeted oil, gas, banking, insurance and property sectors as laggards in setting net zero emissions targets.

Asset managers and banks are emerging as a key lever in steering the world away from high-carbon activities, given their power to choke off harmful businesses by restricting access to capital. In Europe, green investments are supported by an expanding set of regulations while in the US, the Inflation Reduction Act has unleashed an historic wave of green subsidies.

At the same time, investments that take ESG into account have increasingly come under political attack as Republicans in the US accuse such policies of being anti-American. That’s starting to affect investment patterns, with European and US flows diverging somewhat.

ESG flows into exchange-traded funds in Europe may “experience strength” supported by “favorable policies,” while in the US, demand may “continue to weaken,” according to a recent analysis by Bloomberg Intelligence.

LGIM said it “significantly” expanded its so-called climate engagements over the past 12 months, which now affects 5,000 companies. The asset manager also said that as part of its climate impact pledge it will step up scrutiny of biodiversity risk and climate lobbying among portfolio companies.

LGIM has now identified 299 companies that qualify for voting sanctions at annual general meetings, after failing to meet its climate standards. A further 43 companies — dubbed dial movers by LGIM, due to their size and potential to bring about change — will also face sanctions, it said.

LGIM’s Exclusion List:

- AIG

- Air China Ltd.

- China Construction Bank

- China Resources Cement

- Cosco Shipping Holdings Co.

- Exxon Mobil

- Hormel

- Industrial Commercial Bank of China

- Invitation Homes

- KEPCO

- Loblaw

- MetLife

- PPL

- Sysco

LGIM said funds affected by its divestment policy include the Future World fund offerings, its ESG funds and all auto-enrollment default funds in L&G Workplace Pensions and the L&G Mastertrust.

Companies are divested up to a pre-specified tracking-error limit. If the tracking-error limit is reached, holdings are reduced rather than fully divested, it said.