Cloud services companies are rallying as earnings reports suggest the wave of spending cuts that had hammered the industry are starting to subside.

Amazon.com Inc. on Thursday said that growth at its Amazon Web Services unit was “stabilizing” after a steep slowdown. Atlassian Corp., a builder of productivity software, cited “strong momentum” in customers moving to cloud services. Last week, Alphabet Inc.’s Google cloud unit posted a sales increase of 28% and higher-than-expected profit.

The cloud market will continue to expand at a healthy rate, said John Dinsdale of Synergy Research group.

“The macroeconomic environment is slowly heading in the right direction,” Dinsdale said in a research note. The cloud providers are likely to get a bump as companies increase their use of generative artificial intelligence, he added.

Amazon and Atlassian surged 11% and 19%, respectively, on Friday. Microsoft Corp. gained almost 2%, while Alphabet rose about 1%.

Cloud companies have been under pressure for much of this year, as their corporate clients sought to trim technology spending that ballooned during the pandemic. Some of their biggest customers – particularly tech companies – rolled out layoffs and deep cost cuts that left them needing less computing power and planning, human resources and other software.

Now, the pace of job cuts has slowed. And industry executives say corporate clients are less likely to try to reduce their cloud bills. Amazon Chief Financial Officer Brian Olsavksy said that while some of that was still going on during the second quarter, it appeared the drive to cut costs may be ending for some larger customers. “Now we’re seeing more progression into new workloads, new business,” he said.

Amazon’s AWS, the largest provider of on-demand computing power, said second-quarter sales rose by 12%, better than analysts were expecting. Analysts in the last week have raised their estimates for the unit’s 2024 sales by the most since July 2022.

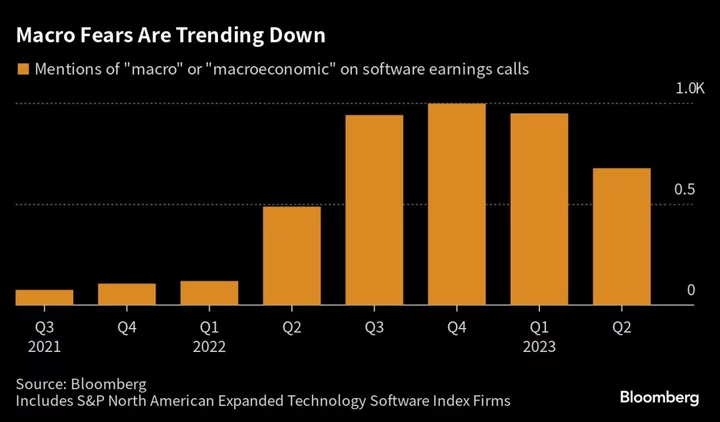

Starting last year, tech executives began blaming much of the slump on the unsettled economy. In the most recent round of earnings, they talked less about economic trends, suggesting increased optimism. References to the global economy during software company earnings calls peaked in the fourth quarter of 2022.

Like many software peers, Atlassian’s cloud growth had been in free-fall since last year. Headed into earnings Thursday, investors were anxious that penny-pinching and layoffs meant that expansion would continue to slow. Instead, executives essentially said the pullback had bottomed out. Even if economic conditions fail to improve in the new fiscal year, there are signs that customers will continue to grow.

“We do expect cloud revenue growth rates to gradually improve throughout the year,” Atlassian CFO Joe Binz said.

Still, there are indicators that software spending is under pressure. Atlassian only added half as many new customers as analysts had expected. AWS’s sales growth, though better than feared, was the slowest since Amazon began breaking out the performance of its cloud unit. Growth in Microsoft’s Azure cloud services unit also slowed in the quarter.

The latest earnings reports also delivered a mixed read on exactly when generative artificial intelligence would meaningfully boost sales. Big Tech has been buoyed by expectations that computer models capable of generating written text or images will eventually be a windfall.

For more on the cloud anxiety that gripped the industry earlier this year

For software builders, such tools open the door to infusing their products with more powerful capabilities and a higher price tag. Cloud infrastructure companies expect to see more activity at their server farms as customers refine large language models that require tremendous amounts of computing power.

Oracle Corp., long a laggard in cloud, reported in June that its cloud infrastructure unit accelerated to 76% growth, fueled in part by companies doing large language model development. More than $2 billion in cloud capacity has recently been contracted by companies doing such work, including Mosaic ML, Adept AI and Cohere, Oracle Chairman Larry Ellison said in a June release.

Others didn’t have specific figures on when the hype around generative AI might translate into sales. Microsoft Chief Executive Officer Satya Nadella predicted last week that “the real revenue signal” would arrive in 2024.

“It’s really early,” Amazon CEO Andy Jassy said on an earnings call Thursday. “I think most companies are still figuring out how they want to approach it.”