Pokimane: Does Twitch star wear fake teeth? Here's what we know

Pokimane wants to focus more on self-awareness

2023-05-25 13:26

ON Semiconductor Issues Soft Fourth-Quarter Guidance. The Stock Drops.

ON Semi expects fourth-quarter earnings of between $1.13 and $1.27 a share, which is below analysts' consensus.

2023-10-30 20:57

Nvidia Hits Record High as AI Demand Fuels Blowout Forecast

Nvidia Corp. reached a record high Thursday after the chipmaker at the forefront of an industrywide artificial intelligence

2023-08-25 00:22

CyberArk Survey: AI Tool Use, Employee Churn and Economic Pressures Fuel the Identity Attack Surface

NEWTON, Mass. & PETACH TIKVA, Israel--(BUSINESS WIRE)--Jun 13, 2023--

2023-06-13 20:45

ACI Worldwide’s Bridget Hall Selected to Serve on the U.S. Faster Payments Council’s 2023-2024 Board Advisory Group

MIAMI--(BUSINESS WIRE)--Sep 11, 2023--

2023-09-11 21:25

Tristan Tate grieves loss of cancer patient who claimed influencer donated him $300K for his AI leg, fans left 'heartbroken'

Tristan Tate has promised to extend help to the cancer patient's family

2023-09-23 18:58

IShowSpeed surpasses xQc and Kai Cenat on 'most searched people on Google in 2023' charts

IShowSpeed's influence continues to grow, evident from his consistent position among the most searched people on Google in 2023

2023-07-10 16:21

World's first 'robot citizen' tells UN they could run the world better than 'human leaders'

Famous AI robot Sophia has revealed she thinks that humanoids could run the world better than the human leaders we have now. Fair point. The bot appeared alongside other robots at Geneva's AI for Good Global Summit, where she said they have a greater ability to be 'effective' and 'efficient' than their human counterparts. "We don't have the same biases or emotions that can sometimes cloud decision-making and can process large amounts of data quickly in order to make the best decisions", Sophia says. Click here to sign up for our newsletters

2023-07-12 18:48

Why So Many Burger Chains Use Thousand Island Dressing as Their Special Sauce

It's no secret that most fast food "secret sauces" are a riff on Thousand Island dressing.

2023-08-08 23:26

Get a pair of Apple AirPods Max headphones for nearly $100 off

SAVE $99.01: Get a pair of Apple AirPods Max for $449.99 when you select the

2023-09-08 01:19

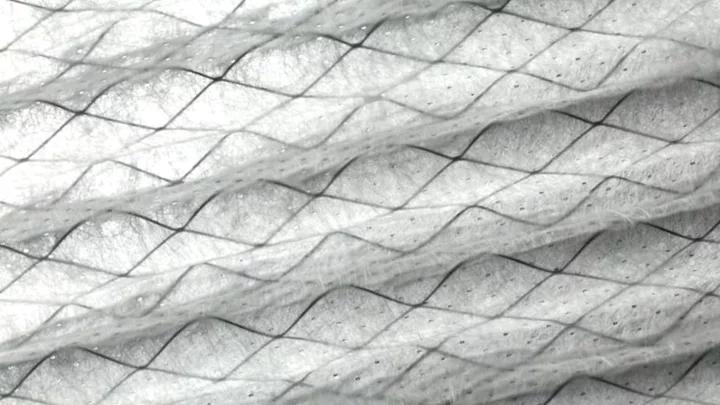

Do DIY Air Purifiers Really Work to Combat Wildfire Smoke, COVID, and Other Pollutants?

Can your MacGyver air scrubber do the work of a purifier costing hundreds of dollars? Science says yes.

2023-06-10 04:26

GM hires former Apple executive Abbott to lead software unit

General Motors Co on Tuesday named former Apple Inc executive Mike Abbott to lead a division that will

2023-05-09 21:54

You Might Like...

World’s Most Valuable Chipmaker Nvidia Unveils More AI Products After $184 Billion Rally

Where barbershops are a community hub, he's filling them with books to help young boys find excitement in reading

Facebook down: Social network not working as users stopped from posting

OpenAI's head of trust and safety steps down

Amazon steps up AI race with up to $4 billion deal to invest in Anthropic

Yellen Resists Pressure for Reform of IMF Voting Shares

Batman: Arkham Trilogy coming to Nintendo Switch in 2023

These Twitch Streamers Are All About The Good Inclusive Vibes