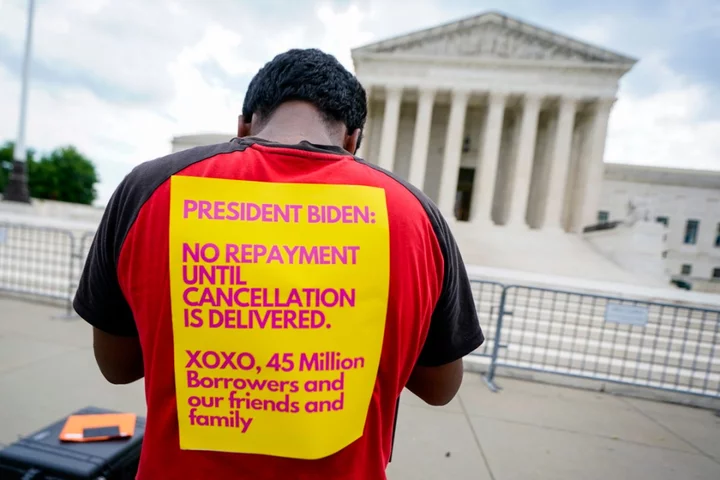

Biden reveals ‘new path’ to student debt relief after Supreme Court strikes down president’s plan

After the US Supreme Court struck down his administration’s plan to cancel federal student loan debts for millions of Americans, President Joe Biden has unveiled a “new path” for relief, one that he assured is “legally sound” but will “take longer”. In remarks from the White House on 30 June, the president hit out at Republican state officials and legislators who supported the lawsuit which enabled the nation’s highest court to strike down his student debt forgiveness initiative, accusing many of them of hypocrisy for taking money from pandemic-era relief programs while opposing relatively meager relief for student loan borrowers. “Some of the same elected Republicans, members of Congress who strongly opposed relief for students, got hundreds of thousands of dollars themselves ... several members of Congress got over a million dollars — all those loans are forgiven,” he said. “The hypocrisy is stunning,” he said. Accompanied by Secretary of Education Miguel Cardona, Mr Biden opened his remarks by acknowledging that there are likely “millions of Americans” who now “feel disappointed and discouraged or even a little bit angry about the court’s decision today on student debt”. “And I must admit, I do too,” he said. Still, Mr Biden reminded Americans that his administration has previously taken actions to reform student loan repayment programs to make them easier to access, and to keep borrowers from spending more than five per cent of disposable income on monthly repayments, and to strengthen loan forgiveness options for borrowers who take public service jobs. The president has directed Mr Cardona to “find a new way” to grant similar loan relief “as fast as we can” in a way that is “consistent” with the high court’s decision. On Friday, the Education Department issued the first step in the process of issuing new regulations under this so-called “negotiated rulemaking” process. In the mean time, Mr Biden said his administration is creating a temporary year-long “on-ramp repayment programme” under which conditions will remain largely the same as they have during the three-year pandemic-era pause in payments which is set to expire this fall. The department’s 12-month “on ramp” to begin repayments, from 1 October through 30 September, aims to prevent borrowers who miss repayments in that time period from delinquency, credit issues, default and referral to debt collection agencies. “During this period if you can pay your monthly bills you should, but if you cannot, if you miss payments, this on-ramp temporarily removes the threat of default,” he said. “Today’s decision closed one path. Now we’re going to pursue another — I’m never gonna stop fighting,” the president continued, adding that he will use “every tool” at his disposal to get Americans the student debt relief they need so they can “reach [their] dreams”. “It’s good for the economy. It’s good for the country. It’s gonna be good for you,” he said. Asked by reporters whether he’d given borrowers false hope by initiating the now-doomed forgiveness plan last year, Mr Biden angrily chided the GOP for having acted to take away the path to debt relief for millions. “I didn’t give any false hope. The question was whether or not I would do even more than was requested. What I did I felt was appropriate and was able to be done and would get done. I didn’t give borrowers false hope. But the Republicans snatched away the hope that they were given and it’s real, real hope,” he said. The Supreme Court’s 6-3 ruling from the conservative majority argues that the president does not have the authority to implement sweeping relief, and that Congress never authorised the administration to do so. Under the plan unveiled by the Biden administration last year, millions of people who took out federally backed student loans would be eligible for up to $20,000 in relief. Borrowers earning up to $125,000, or $250,000 for married couples, would be eligible for up to $10,000 of their federal student loans to be wiped out. Those borrowers would be eligible to receive up to $20,000 in relief if they received Pell grants. Roughly 43 million federal student loan borrowers would be eligible for that relief, including 20 million people who stand to have their debts cancelled completely, according to the White House. Lawyers for the Biden administration contended that he has the authority to broadly cancel student loan debt under the Higher Education Relief Opportunities for Students Act of 2003, which allows the secretary of education to waive or modify loan provisions following a national emergency – in this case, Covid-19. Since March 2020, with congressional passage of the Cares Act, monthly payments on student loan debt have been frozen with interest rates set at zero per cent. That pandemic-era moratorium, first enacted under Donald Trump and extended several times, was paused a final time late last year. Over the last decade, the student loan debt crisis has exploded to a balance of nearly $2 trillion, most of which is wrapped up in federal loans. The amount of debt taken out to support student loans for higher education costs has surged alongside growing tuition costs, increased private university enrollment, stagnant wages and GOP-led governments stripping investments in higher education and aid, putting the burden of college costs largely on students and their families. Read More Supreme Court strikes down Biden’s plan to cancel student loan debts Supreme Court strikes down affirmative action, banning colleges from factoring race in admissions Biden condemns Supreme Court striking down affirmative action: ‘This is not a normal court’ Justice Ketanji Brown Jackson delivers searing civil rights lesson in dissent to affirmative action ruling

2023-07-01 04:47

Twitter Blocks People From Seeing Tweets Unless a Registered User

Twitter is blocking people from viewing tweets and profiles on its website unless they are signed in to

2023-07-01 03:00

US Spies Issue Warnings Over Risks of Doing Business in China

US intelligence officials renewed warnings for American companies doing business in China, citing an update to a counterespionage

2023-07-01 02:59

Artificial Intelligence Companies Hunt for San Francisco Offices

Hive, an artificial intelligence company, is subleasing three floors of a downtown San Francisco office, a sign of

2023-07-01 01:57

Serbia media guide

An overview of the media in Serbia, including links to broadcasters and newspapers.

2023-07-01 00:56

Student-Loan Relief Backers Amp Up Pressure on Biden After Supreme Court Ruling

Student-loan relief advocates are pressing President Joe Biden to find other ways to forgive college debts after the

2023-07-01 00:19

Biden Will Detail New Steps on Debt Relief After Supreme Court Ruling

President Joe Biden will announce new steps to protect student-loan borrowers after the Supreme Court threw out his

2023-06-30 23:49

Supreme Court strikes down Biden’s plan to cancel student loan debts

The US Supreme Court has struck down President Joe Biden’s plan to cancel student loan debts for millions of Americans, reversing his campaign-trail promise as borrowers prepare to resume payments this summer. Chief Justice John Roberts delivered the 6-3 decision from the court’s conservative majority. The ruling, which stems from a pair of cases challenging the Biden administration and the US Department of Education, argues that the president does not have authority to implement sweeping relief, and that Congress never authorised the administration to do so. Within 30 minutes on the last day of its term, the court upended protections for LGBT+ people and blocked the president from a long-held promise to cancel student loan balances amid a ballooning debt crisis impacting millions of Americans. Under the plan unveiled last year, millions of people who took out federally backed student loans would be eligible for up to $20,000 in relief. Borrowers earning up to $125,000, or $250,000 for married couples, would be eligible for up to $10,000 of their federal student loans to be wiped out. Those borrowers would be eligible to receive up to $20,000 in relief if they received Pell grants. Roughly 43 million federal student loan borrowers would be eligible for that relief, including 20 million people who stand to have their debts canceled completely, according to the White House. Roughly 16 million already submitted their applications and received approval for debt cancellation last year, according to the Biden administration. The long-anticipated plan for debt cancellation was met almost immediately with litigation threats from conservative legal groups and Republican officials, arguing that the executive branch does not have authority to broadly cancel such debt. Six GOP-led states sued the Biden administration to stop the plan altogether, and a federal appeals court temporarily blocked any such relief as the legal challenges played out. Since March 2020, with congressional passage of the Cares Act, monthly payments on student loan debt have been frozen with interest rates set at zero per cent. That Covid-19-pandemic era moratorium, first enacted under Donald Trump and extended several times, was paused a final time late last year – until the Education Department is allowed to cancel debts under the Biden plan, or until the litigation is resolved, but no later than 30 June. Payments would then resume 60 days later. The amount of debt taken out to support student loans for higher education costs has surged within the last decade, alongside growing tuition costs, increased private university enrollment, stagnant wages and GOP-led governments stripping investments in higher education and aid, putting the burden of college costs largely on students and their families. The crisis has exploded to a total balance of nearly $2 trillion, mostly wrapped up in federal loans. Millions of Americans also continue to tackle accrued interest without being able to chip away at their principal balances, even years after graduating, or have been forced to leave their colleges or universities without obtaining a degree at all while still facing loan repayments. Borrowers also have been trapped by predatory lending schemes with for-profit institutions and sky-high interest rates that have made it impossible for many borrowers to make any progress toward paying off their debt, with interest adding to balances that exceed the original loan. One analysis from the Education Department found that nearly 90 per cent of student loan relief would support people earning less than $75,000 per year. The median income of households with student loan balances is $76,400, while 7 per cent of borrowers are below the poverty line. That debt burden also falls disproportionately on Black borrowers and women. Black college graduates have an average of $52,000 in student loan debt and owe an average of $25,000 more than white graduates, according to the Education Data Initiative. Four years after graduating, Black student loan borrowers owe an average of 188 per cent more than white graduates. Women borrowers hold roughly two-thirds of all student loan debt, according to the American Association of University Women. Mr Biden’s announcement fulfilled a campaign-trail pledge to wipe out $10,000 in student loan debt per borrower if elected, though debt relief advocates and progressive lawmakers have urged him to cancel all debts and reject means-testing barriers in broad relief measures. In November 2020, the president called on Congress to “immediately” provide some relief for millions of borrowers saddled by growing debt. “[Student debt is] holding people up,” he said at the time. “They’re in real trouble. They’re having to make choices between paying their student loan and paying the rent.” This is a developing story Read More Supreme Court allows Colorado designer to deny LGBT+ customers in ruling on last day of Pride Month Biden condemns Supreme Court striking down affirmative action: ‘This is not a normal court’ Justice Ketanji Brown Jackson delivers searing civil rights lesson in dissent to affirmative action ruling

2023-06-30 23:16

Melania Trump hawks $50 NFTs to ‘celebrate our great nation’ ahead of July 4

Melania Trump is launching a collection of $50 non-fungible tokens (NFTs) featuring US landmarks in time for the 4th of July. The former first lady’s “1776 Collection” includes images of Mount Rushmore, the Statue of Liberty and the Liberty Bell, set to patriotic-themed music. Ms Trump’s office said in a statement that each NFT was designed to celebrate the “foundations of American ideals”. “The 1776 Collection of artwork draws inspiration from several iconic landmarks of our nation, which I had the privilege of visiting during the time I served as first lady,” Ms Trump said. “I am proud to celebrate our great nation and remain inspired by the words contained within the Declaration of Independence.” An NFT is a blockchain-based certificate verifying ownership. The 1776 Collection was created on the Solana blockchain, and went on sale on Thursday. Ms Trump’s office said a portion of the sale price would go to support foster children. The site did not immediately respond to a request for further details about what percentage of the proceeds would be donated. Ms Trump has previously dabbled in NFTs since leaving the White House. In 2021, she launched a digital watercolour painting of her eyes for $180 each. Then in 2022, Ms Trump faced accusations of bidding $185,000 in an auction for her “Head of State Collection 2022.” An analysis of Solana blockchain transactions by Bloomberg found the winning bid of 1800 SOL came from a wallet that belonged to the entity that originally listed the project for sale. Read More Trump news - live: DOJ prepares to hit Trump with new charges as ex-official cooperates in 2020 election probe Trump lashes out at ‘fake’ Jake Tapper after CNN host cuts away from arraigned ex-president meeting fans Meet Jesse Watters, the Fox News host helming Tucker Carlson’s primetime slot Prosecutors are prepared to hit Trump and his allies with new charges, sources say

2023-06-30 22:19

South Africa Needs to Deal With ‘Energy Poverty,’ Minister Says

South Africa must balance the need to cut emissions with increasing electricity access and developing its natural resources,

2023-06-30 18:58

Sunak Slammed Over Environment as UK Climate Minister Quits

Climate Minister Zac Goldsmith quit Rishi Sunak’s UK government on Friday with an excoriating broadside against the prime

2023-06-30 18:16

Amid US pressure, Dutch announce new chip equipment export rules

AMSTERDAM The Dutch government on Friday announced new rules restricting exports of certain advanced semiconductor equipment, a move

2023-06-30 15:50